Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

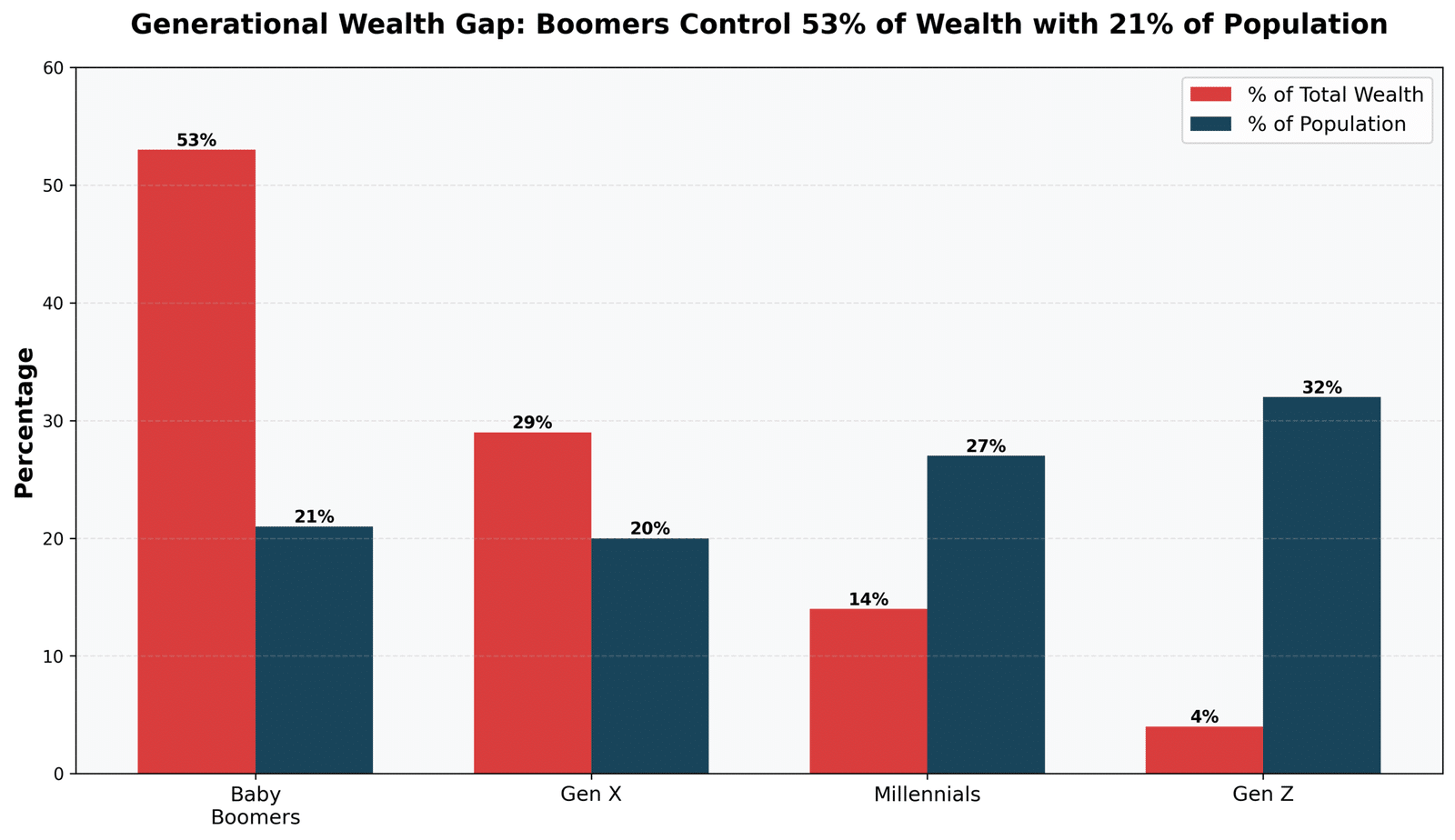

How baby boomers ruined the economy is a question backed by four decades of data. Between 1980 and 2024, they enacted policies that inflated housing prices by 400%, quadrupled college costs, and accumulated $35 trillion in national debt—all while voting for tax cuts that primarily benefited themselves. Today, Boomers control 53% of U.S. wealth despite representing only 21% of the population, leaving Millennials and Gen Z with stagnant wages, crushing debt, and vanishing economic opportunity. Understanding exactly how baby boomers ruined the economy requires examining housing, education, wages, debt, and climate policy choices that systematically transferred wealth from young to the old.

Baby Boomers didn’t just buy homes—they weaponized them. In the 1970s and 80s, Boomers purchased affordable starter homes with median prices around $47,000 (adjusted for inflation: $170,000 in 2024 dollars). Then they pulled the ladder up behind them.

The Zoning Scam: Once they owned property, Boomers voted overwhelmingly for restrictive zoning laws that blocked new housing construction. Cities like San Francisco, Seattle, and Boston became Boomer fortresses where single-family zoning prevented the density needed to accommodate growing populations. The result? Artificial scarcity that sent home prices skyrocketing. This is precisely how baby boomers ruined the economy for younger generations trying to build wealth through homeownership.

By the Numbers:

Boomers turned housing from a basic need into a speculative asset class. They refinanced repeatedly to extract equity, treating homes like ATMs while younger generations couldn’t even get through the door. According to the Federal Reserve, homeownership rates for Americans under 35 have plummeted from 43% in 2005 to 37% in 2024.

Read more: Cost of Living Increases by Generation

Boomers attended college when tuition was cheap—often just a few hundred dollars per semester at public universities. Many worked part-time summer jobs and graduated debt-free. Then they systematically defunded higher education and told Millennials, “You MUST go to college to succeed.”

The Bait-and-Switch:

State legislatures—dominated by Boomer politicians—slashed education funding by over 30% between 1990 and 2020. Universities compensated by jacking up tuition and relying on student loans. The result? $1.7 trillion in student debt crushing an entire generation. When examining how baby boomers ruined the economy, the student debt crisis stands as one of the most damning pieces of evidence.

But here’s the real kicker: Boomers didn’t stop at making college unaffordable. They also devalued the degrees themselves by flooding the market with credential requirements for entry-level jobs. Now you need a bachelor’s degree to answer phones—a job Boomers did with a high school diploma.

Read more: Student Loan Forgiveness Counts as Income

Boomers are the first—and likely last—generation to enjoy guaranteed pensions AND Social Security windfalls. They lived through the golden age of defined-benefit retirement plans, then voted to eliminate them for everyone else.

The Pension Betrayal: In the 1980s and 90s, Boomer-led corporations systematically replaced pensions with 401(k) plans—shifting all investment risk onto workers. Meanwhile, Boomers who had already locked in their pensions kept them. Corporate executives (mostly Boomers) pocketed the savings. This pension bait-and-switch perfectly illustrates how baby boomers ruined the economy for future workers.

Social Security Math: Social Security was designed as a generational compact: workers pay in, retirees draw out. But Boomers are draining the system at an unprecedented rate:

Boomers have taken out far more than they paid in. According to the Urban Institute, the average Boomer couple will receive $1 million in Social Security and Medicare benefits while contributing just $600,000 in taxes. That $400,000 gap? Younger generations are paying for it.

Read more: Millennials and Gen Z Healthcare Benefits

Boomers voted for massive government spending increases—especially on defense and Medicare—while simultaneously demanding tax cuts. The result is a $35 trillion national debt that Millennials and Gen Z will spend their entire lives servicing.

The Timeline of Theft:

Every single one of these cuts disproportionately benefited Boomers at the peak of their earning years. Meanwhile, federal spending on education, infrastructure, and social programs for younger Americans was gutted. Understanding how baby boomers ruined the economy requires examining this deliberate debt-and-tax-cut strategy that enriched one generation at the expense of all others.

The Burden by Generation:

Boomers borrowed against the future and left younger generations holding the bill. They enjoyed the benefits of government spending without paying for it—the ultimate “screw you, I got mine” mentality.

Read more: Oppose Cutting the Defense Budget

The chart above reveals the shocking truth: Baby Boomers control 53% of total U.S. wealth despite making up only 21% of the population. Meanwhile, Millennials—who represent 27% of the population—control just 14% of wealth. Gen Z, at 32% of the population, owns a pitiful 4%.

This isn’t an accident. It’s the result of deliberate policy choices made by Boomer politicians and voters over four decades. Every statistic, every chart, every data point confirms the same reality: how baby boomers ruined the economy through systematic wealth extraction disguised as “economic growth.” They didn’t just benefit from prosperity—they actively rigged the system to transfer wealth upward while pulling the ladder up behind them.

While Boomers enjoyed union protections and strong labor laws early in their careers, they spent the next 40 years dismantling those same protections for younger workers.

The Union Buster Generation:

Boomers voted overwhelmingly for politicians who gutted labor rights, outsourced manufacturing, and enabled the “gig economy” that treats workers as disposable contractors. They extracted maximum value from corporate profits while ensuring younger workers had zero leverage. Labor economists studying how baby boomers ruined the economy consistently point to this systematic destruction of worker bargaining power as a primary driver of wage stagnation.

Real Wage Growth (1979-2024):

The wealth didn’t trickle down—it flooded up. Boomers rigged the game, and then lectured younger generations about “working harder.”

Read more: Policies That Help American Workers

This isn’t a partisan issue—it’s a generational one. Both Democrats and Republicans are Boomer-dominated establishments that prioritize their generation’s interests over everyone else’s.

The uniparty establishment—Boomer politicians on both sides—has one goal: preserve their wealth and power. Neither party represents younger Americans. When you look at how baby boomers ruined the economy, you see bipartisan cooperation: both parties worked together to transfer wealth upward and burden future generations with debt. That’s why we need to fight the establishment, not pick sides in their rigged game.

Boomers knew about climate change since the 1970s—scientists warned them repeatedly. Instead of acting, they doubled down on fossil fuels, blocked renewable energy development, and left future generations with an unlivable planet and massive economic cleanup costs.

The Evidence Was Clear:

The cost of climate inaction will fall entirely on Millennials and Gen Z. Extreme weather, mass migration, and ecosystem collapse—all preventable if Boomers had acted. But they chose short-term profits over long-term survival. Climate economists now calculate that how baby boomers ruined the economy includes trillions in deferred environmental costs that younger generations must pay.

The damage is done, but the future doesn’t have to be Boomer-controlled. Here’s what needs to happen:

Boomers won’t fix this. We have to. Every election, every protest, every policy fight is a chance to reclaim what they stole.

Baby Boomers didn’t just live through economic prosperity—they hoarded it, weaponized it, and left future generations to pick up the pieces. From housing to education to climate change, every major crisis facing Millennials and Gen Z can be traced back to Boomer policies and Boomer greed.

This isn’t about hating your parents. It’s about holding a generation accountable for systemic theft. The economy didn’t “just happen” to become unaffordable—Boomers made it that way. And until we acknowledge how baby boomers ruined the economy through deliberate policy choices over four decades, we can’t fix it.

The question isn’t whether Boomers ruined the economy. It’s whether we’re brave enough to take it back.