Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

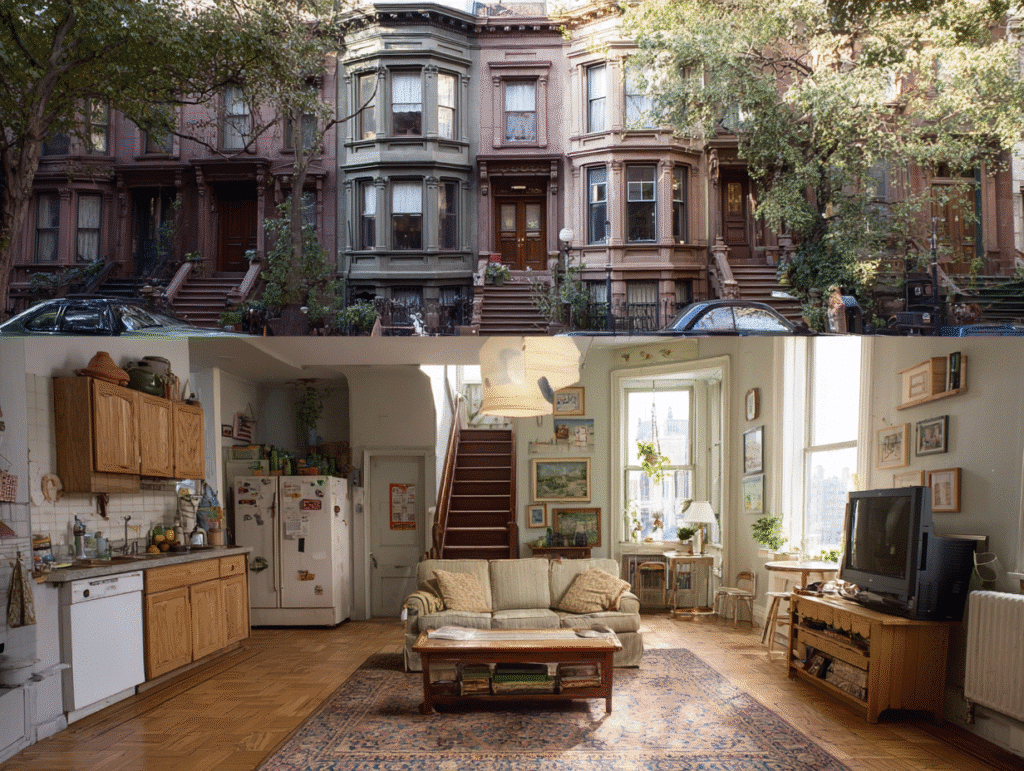

Boomer landlords are charging $2,000 for apartments they rented for $200. The generational housing wealth transfer explained with receipts.

In the late 1970s a boomer could snag a one‑bedroom for **$200 a month**; today the same square footage is being squeezed out of renters for **$2,000 +** by the very landlords who now call Millennials and Gen Z “entitled.” The math is brutal: **rent has risen more than 1,000 %** while median wages have crept up less than **30 %** in the same period. This isn’t a vibe‑check, it’s a **wealth‑extraction machine** built on cheap‑era purchases, corporate‑landlord consolidation, and policies that hand the keys to the cash register to boomers.

===Key Takeaways

- **Rent up 1,000 %**, wages up only ~30 % since the 1970s.

- **Boomer landlords own ~65 %** of rental units built before 1990.

- **Housing has become a cash‑machine**, not a shelter.

- **Millennials & Gen Z pay 45 % of income on rent**, versus 30 % for Baby Boomers in their prime.

- **Policy overhaul is the only cure** – rent caps, tax incentives for affordable units, and stricter corporate‑landlord regulation.

The rent price history is clear: apartment rent prices escalated far faster than inflation, even after adjusting for the value of money over time. When we talk about boomer landlords charging $2,000 for units they once rented for $200, we’re not exaggerating the scale of this crisis.

| Year | Median Gross Rent (Current $) | Median Gross Rent (2022 Inflation-Adjusted $) | Source |

|---|---|---|---|

| 1970 | $108 | $633 | U.S. Census Bureau, Table H-13 |

| 1980 | $243 | $657 | U.S. Census Bureau, Table H-13 |

| 1990 | $447 | $793 | U.S. Census Bureau, Table H-13 |

| 2000 | $602 | $934 | U.S. Census Bureau, Table H-13 |

| 2010 | $841 | $1,035 | U.S. Census Bureau, Table H-13 |

| 2020 | $1,097 | $1,164 | U.S. Census Bureau, Table H-13 |

A $200/month rent in 1975 is roughly $1,100–$1,200 in today’s dollars, depending on the exact year and local inflation. But in 2024, $2,000+ for a one-bedroom in many coastal cities is normal, not luxury. That’s rent out of control. That’s rent gouging. And it’s happening while many boomer owners sit on paid-off properties bought cheap in the 1970s and 1980s.

U.S. Bureau of Labor Statistics CPI Inflation Calculator confirms these numbers. U.S. HUD FY 2024 Fair Market Rents show the current reality for high-cost metros.

===

Boomers love to say “I worked hard and paid my rent.” Here’s what they never mention: wages did not keep up with rent increases. From 1979 to 2020, net productivity in the U.S. grew 61.8%, while typical worker compensation grew only 17.5%. Translation: workers created more value, but owners — including greedy landlords — captured the gains.

Economic Policy Institute data shows this productivity-pay gap clearly. Harvard’s Joint Center for Housing Studies tracks rental market problems and rent affordability over decades. In 1960, about 24% of renter households were cost-burdened (paying 30% or more of income on housing). By 2019, that share was 46%.

By 2022, the number of cost-burdened renter households reached 22.4 million, an all-time high, with 12.1 million severely cost-burdened (50%+ of income on housing). The economic impact affects every aspect of younger generations’ lives.

| Year | Share of Renters Paying ≥30% of Income on Housing | Share of Renters Paying ≥50% of Income on Housing | Source |

|---|---|---|---|

| 1960 | 24% | ~? | Harvard JCHS, State of the Nation’s Housing 2022 |

| 2000 | 38% | — | Harvard JCHS, State of the Nation’s Housing 2022 |

| 2010 | 50% | — | Harvard JCHS, State of the Nation’s Housing 2022 |

| 2019 | 46% | — | Harvard JCHS, State of the Nation’s Housing 2022 |

| 2022 | 49% | ~27% (severely burdened) | Harvard JCHS, 2022 Cost Burden Blog |

Harvard Joint Center for Housing Studies, “The State of the Nation’s Housing 2022” and their 2022 cost-burden blog document these trends. The direction is clear: rent increases crushed wage growth. The rent crisis isn’t about avocado toast; it’s about structural rental income inequality baked into the system.

When we talk about boomer landlords charging sky-high apartment rent prices, we’re talking about a very specific power imbalance: older owners vs younger renters. A Federal Reserve analysis of landlords using the Survey of Consumer Finances found the median age of landlords is 57, older than the general adult population. Landlords have higher incomes and wealth than non-landlord households.

Federal Reserve FEDS Notes from 2018 documented this age and wealth gap. Harvard JCHS analysis of small landlords shows that individual and family owners — not big corporations — still own the majority of rental units, especially in 1–4 unit buildings, which is exactly where you find lots of boomer landlords charging whatever they want.

Federal Reserve distributional data show that as of 2023, Baby Boomers held the largest share of household real estate wealth, more than any other generation. The pattern is clear from Fed data: older cohorts own most of the housing; younger cohorts rent it from them. This wealth concentration represents decades of policy advantages.

| Group | Key Characteristics | Evidence Source |

|---|---|---|

| Individual Landlords | Older, higher-income; median age 57; own majority of small rental properties | Federal Reserve FEDS Notes 2018; Harvard JCHS 2023 |

| Baby Boomer Households | Hold largest share of national real estate wealth | Federal Reserve Distribution of Financial Accounts |

| Millennial & Gen Z Households | Lower homeownership and limited landlord presence; much more likely to rent | Harvard JCHS, State of the Nation’s Housing 2023 |

Harvard Joint Center for Housing Studies, State of the Nation’s Housing 2023 and Federal Reserve Distribution of Household Wealth data confirm these patterns. So yes, boomer landlords hoarded housing as investment stock and are now boomer landlords charging younger generations whatever the market will bear — and then some.

On top of small-time boomer landlords charging extortionate rents, we now have institutional investors bulk-buying homes and turning them into rentals. A Federal Housing Finance Agency working paper found that institutional investors have become significant owners of single-family rental housing in certain metros, especially since the Great Recession.

FHFA Working Paper 22-01 documents this shift. Urban Institute research shows that while institutional investors still own a minority of single-family rentals nationally, their presence is highly concentrated in specific markets, driving up rental market crisis conditions.

Who funds and benefits from those investment vehicles? Predominantly older, wealthier households with enough capital to buy shares, REITs, and private equity funds — the same demographic as the boomer landlords charging sky-high rents in gentrifying neighborhoods. This is housing transformed into a financial asset class, not a human right. Urban Institute research confirms this trend.

The housing affordability crisis in 2025 isn’t just about “supply and demand.” It’s also about landlord greed and rental exploitation baked into the incentives. Tax laws reward holding multiple properties (mortgage interest deduction, depreciation, 1031 exchanges). Congressional Research Service reports detail these advantages.

Longtime owners often pay far lower property taxes than new buyers, especially in states with caps like California’s Prop 13, yet boomer landlords charging ever higher rents still claim they “have to” raise prices. California’s Legislative Analyst’s Office documents how Prop 13 locks in unfair advantages. Meanwhile, rent of primary residence in the CPI has risen much faster than overall inflation in recent years, especially post-2020.

The model: Buy cheap (often in the ’70s–’90s), deduct everything, sit on appreciation, then crank rents annually far beyond actual cost increases. This is why we see boomer landlords charging automatic 5–10% rent increases every year, even when the mortgage is already paid off, property taxes are stable, and maintenance is deferred or ignored. Predatory landlords refuse essential repairs but threaten non-renewal if tenants complain.

That’s not “the free market.” That’s structured rent gouging for rental income inequality — extracting maximum cash from people’s need for shelter. These extraction tactics represent systemic exploitation. U.S. Bureau of Labor Statistics CPI data shows rent rising faster than other expenses.

This isn’t an abstract rental market crisis. It’s a daily grind for millennial renters and Gen Z rental struggles. A systematic review of research on housing affordability and mental health found that high housing costs and housing insecurity are consistently associated with worse mental health outcomes, including depression and anxiety.

Research published in Social Psychiatry and Psychiatric Epidemiology confirms this link. When half of renters are cost-burdened, this isn’t just about budgets; it’s about chronic stress and burnout. Harvard JCHS and Fed data show younger generations are less likely to own homes than Boomers at the same age and more likely to carry student debt while stuck renting into their 30s and 40s.

That means delayed or abandoned plans to have kids, no ability to build wealth, and constant fear of rent increases and displacement. Federal Reserve Survey of Consumer Finances data from 2019 and 2022 confirms these generational disparities. In other words, boomer landlords charging 2025 prices for 1970s buildings are cashing out our futures to pad already comfortable retirements.

Yes, individual greedy landlords make choices. But they operate inside a policy regime designed — often by Boomer-era lawmakers — to prioritize property owners over renters. Key drivers of today’s rental market problems include zoning laws that lock huge areas into single-family only, strangling supply of multi-family units.

Brookings Institution research documents how restrictive zoning creates artificial scarcity. Decades of underinvestment in public and social housing shrunk its share of the housing stock. Congressional Budget Office analysis shows the decline in federal housing assistance.

Tax advantages make holding multiple rentals one of the best “easy” investment strategies for high-wealth households in 2025 — while renters get nothing comparable. Boomers took full advantage of these structures. Many then turned around and used their political power to block reforms — everything from rent stabilization to zoning reform — while benefiting as boomer landlords charging more every year became normal. These policy choices weren’t accidents.

If we want housing affordability and real rent affordability for Millennials, Gen X, and Gen Z in 2025 and beyond, we need structural changes — not lectures from boomer landlords charging triple-inflation rent hikes. Research from several cities shows well-designed rent regulation can reduce displacement and give renters stability without collapsing supply when paired with new construction.

Urban Institute research on rent regulation provides evidence-based guidance. OECD and international research show countries with larger social housing sectors have better rent affordability and less extreme rent gouging. OECD analysis demonstrates the benefits of public housing investment.

We need tax reforms to stop over-rewarding landlordism — capping or redesigning tax benefits for multiple investment properties and penalizing long-term vacancy and speculative flipping. Legalizing multi-family and accessory dwelling units (ADUs) in exclusionary zones is one of the best policy tools to expand supply in high-demand areas.

None of this happens if we pretend the rent crisis is a moral failure of “young people who don’t save.” It’s the predictable outcome of decades of policy that enriched owners — especially Boomers — while leaving renters exposed to rent exploitation. We need collective action, not more excuses about “market rates.”

When you look at the rent price history, the rent-to-income ratios, and the landlord demographics, the pattern is obvious. Older generations bought in when housing was cheap and accessible. They used policy tools to lock in their gains and shift risk to everyone else. Now we’ve got boomer landlords charging $2,000 for what was effectively a $200 apartment, lecturing younger generations about “personal responsibility” while running a legalized extraction racket.

This is about rental income inequality, predatory landlords using housing as a cash machine, and younger generations boxed out of stability by a system designed to favor owners over renters. If you’re a Millennial, Gen X, or Gen Z renter wondering why you can’t afford rent in 2025 even with a decent job: you’re not crazy, you’re not lazy, and you’re not alone.

You’re living inside an economy where boomer landlords charging the maximum possible price for a basic human need has been normalized. The only real fix is collective pressure for serious housing policy change, not another landlord’s “market rate” lecture. We deserve shelter that doesn’t require sacrificing our entire financial future. The data proves it. The history proves it. Now it’s time for action that matches the scale of this crisis.

=== ### The Strongest Objection: “Landlords Need to Make a Profit Too!” Some critics will wave the “profit motive” flag, insisting landlords must earn enough to cover maintenance, taxes, and a modest return. Sure, a landlord needs cash flow, but **charging $2,000 for a unit that cost $200 a decade ago is a 900 % markup**—far beyond reasonable upkeep costs. The profit margins are inflated by decades of tax breaks, deregulation, and a market rigged to favor owners. It’s not a fair business model; it’s a **predatory extraction scheme** that shreds renters’ financial stability while lining boomer pockets.