Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

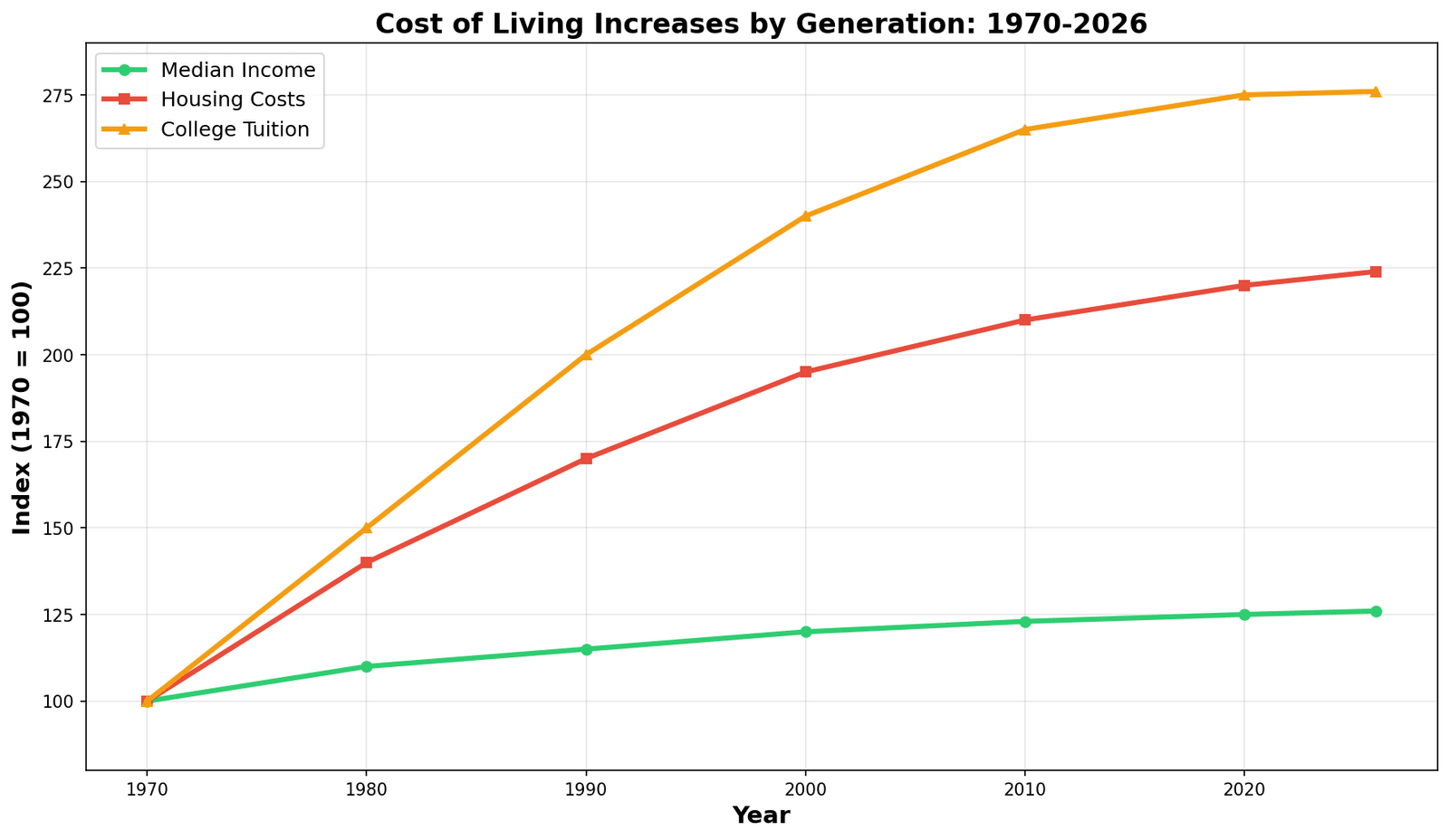

The cost of living increases by generation aren’t just inflation—they’re a calculated wealth transfer. Since 1970, median income has risen 26% while housing costs surged 124% and tuition jumped 176%. For Millennials in 2026, this means 30% less lifetime purchasing power than Boomers had at the same age. The system was redesigned to extract wealth before you could save it.

Here’s the truth that doesn’t get talked about at Thanksgiving dinner: In 1970, a single earner could buy a home for 2.8 times their annual income. By 2026, that ratio has exploded to 6.5x in most markets—and over 10x in cities like Los Angeles or Seattle. This isn’t “the market.” This is a structural barrier designed to keep you renting from the generation that pulled the ladder up behind them.

The U.S. Census Bureau confirms that the cost of living increases by generation have fundamentally decoupled from wage growth. While productivity has doubled since the 1970s, real wages for workers under 35 have flatlined (source: Census.gov). You’re working harder, producing more, and earning less relative to the essentials.

Remember when Boomers told you college was an “investment”? That was true—for them. When they went to school in the 70s and 80s, tuition was affordable. By the time Millennials and Gen Z hit campus, the cost of living increases by generation had turned higher education into a debt trap disguised as opportunity.

The Federal Reserve (FRED) data shows that real median household income has barely budged while asset prices—homes, stocks, land—have skyrocketed. The wealth gap between generations isn’t accidental. It’s policy in action. And if you want to see how this plays out in the rental market, check out how Boomer landlords are charging $3,000 for apartments they rented for $200.

Boomers had pensions. Guaranteed. Safe. Secure. The Uniparty decided that was too expensive—so they gave us the 401(k). A volatile stock market gamble where you take all the risk and Wall Street collects the fees. The cost of living increases by generation mean that even if you max out your 401(k), you’re still starting from a deficit compared to what Boomers had handed to them.

When you combine skyrocketing costs with stagnant wages, the result is a generation that can’t afford to save, can’t afford to retire, and is told it’s their fault for “spending too much on avocado toast.” The gaslighting is the cruelest part. Want to know how this impacts your access to basic care? Read about how Millennials and Gen Z are demanding better healthcare benefits because the system left them behind.

The cost of living increases by generation expose the Big Lie: Hard work doesn’t guarantee security anymore. The system was restructured in the 1980s and 90s to benefit asset owners at the expense of wage earners. Boomers locked in their wealth through policies that gutted unions, deregulated Wall Street, and turned housing into a speculative asset class.

You’re not failing. The game was rigged before you sat down at the table. And if you’re still looking for proof, check out the truth about affordable living in 2026—spoiler: it doesn’t exist for most young workers.

The cost of living increases by generation are not a bug—they’re a feature. The only way forward is to name the system, expose the theft, and demand justice.