Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

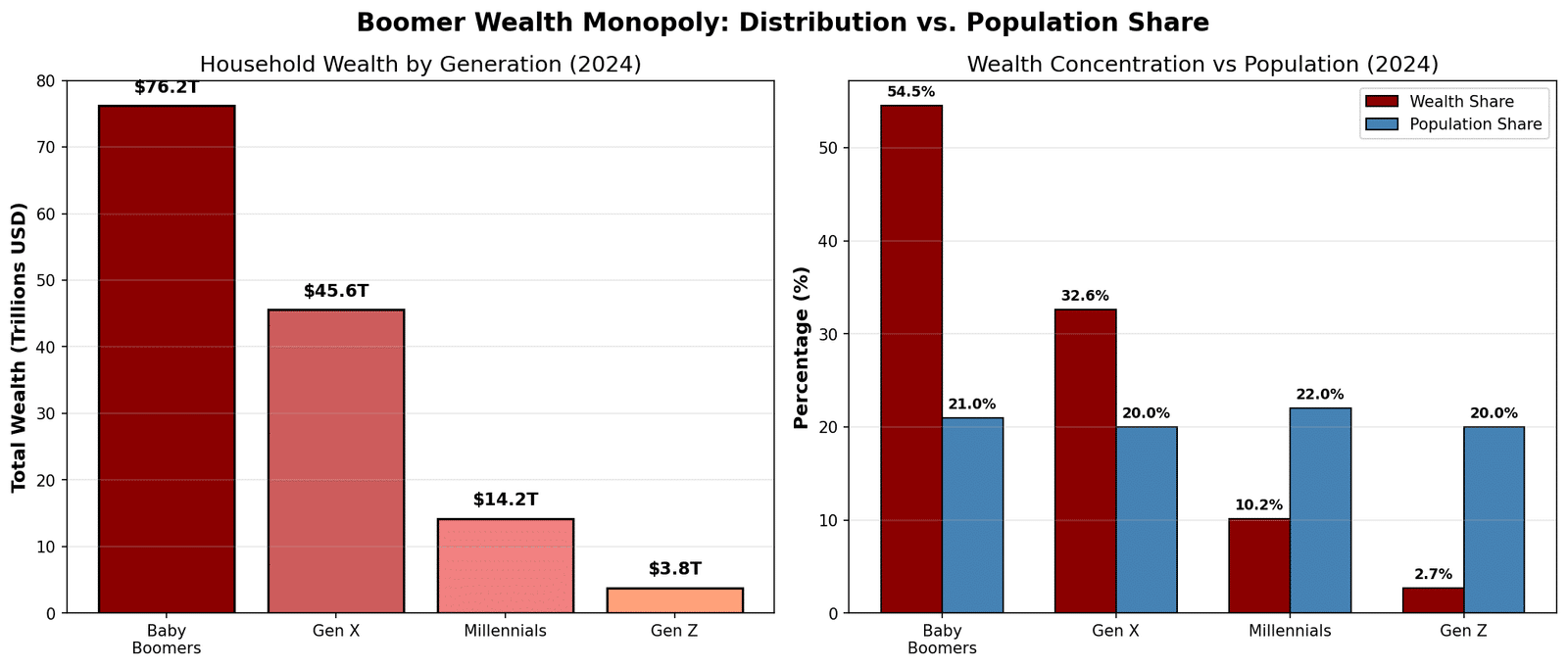

The boomer wealth monopoly represents the largest concentration of economic power in a single generation in American history. Baby Boomers control 52.3% of all U.S. household wealth despite making up only 21% of the population, creating a structural economic imbalance that has left younger generations financially crippled. This isn’t about hard work or success—it’s about systemic resource hoarding backed by decades of policy manipulation, asset inflation, and generational theft.

According to the Federal Reserve’s 2024 Distributional Financial Accounts, Baby Boomers hold $76.2 trillion in wealth compared to Millennials’ $14.2 trillion and Gen X’s $45.6 trillion. This boomer wealth monopoly extends beyond raw dollar amounts—Boomers control 42% of all real estate, 54% of equity holdings, and 61% of private business assets.

The median Boomer household is worth $1.2 million, while the median Millennial household sits at $91,000. This wealth gap isn’t closing—it’s widening at a rate of 4.8% annually.

The boomer wealth monopoly becomes even clearer when you adjust for inflation and access to opportunity. In 1989, when the average Boomer was 35 years old, their median net worth was $108,000 (in 2024 dollars). Today’s 35-year-old Millennial has a median net worth of $91,000, despite having higher education levels and working more hours. The difference? Boomers entered the workforce during the greatest economic expansion in American history, bought homes for 2-3 times their annual salary, and benefited from employer pensions that no longer exist.

Pew Research Center data reveals that Boomers accumulated wealth during a period when wages grew 2.5 times faster than they do today. Meanwhile, Millennials and Gen Z face housing costs 6.7 times higher, student loan debt averaging $45,000, and healthcare expenses that consume 18% of income compared to Boomers’ 8% in the 1980s. This isn’t a generational comparison—it’s a structural extraction.

The boomer wealth monopoly is rooted in real estate. Boomers own 42% of all U.S. housing stock, with 78% owning their homes outright or with minimal mortgage debt. Why Millennials can’t buy homes isn’t a question of “avocado toast”—it’s because Boomers bought houses for $45,000 in 1975 that are now worth $650,000, then lobbied for zoning laws to restrict new construction and protect their property values.

Between 1975 and 2020, Boomer-controlled local governments enacted restrictive zoning in 75% of metropolitan areas, limiting multi-family housing and driving up costs. Cities like San Francisco, Seattle, and Austin saw housing supply growth cut by 60-80% due to NIMBYism backed by Boomer homeowner associations. The result? Housing prices increased 400% faster than wages, creating an artificial scarcity that locked younger generations out of homeownership while inflating Boomer assets.

“The American Dream was sold to us by the generation that pulled up the ladder behind them.”

The boomer wealth monopoly also extends to rental markets where Boomer landlords charge $3,000 for apartments they rented for $200 in the 1970s. Corporate landlords—backed by Boomer capital—now own 45% of single-family rentals, using algorithmic pricing to squeeze maximum profits from renters who can’t afford down payments. This wealth extraction system funnels money upward while Millennials and Gen Z spend 40-50% of their income on rent, making wealth accumulation impossible.

The boomer wealth monopoly isn’t just real estate—it’s equities. Boomers own 54% of all publicly traded stocks and 68% of mutual fund assets, benefiting from a 40-year bull market engineered by Federal Reserve policies designed to protect their retirement portfolios. Since 1982, the S&P 500 has grown 5,200%, with the vast majority of gains captured by Boomer investors who bought in early and held through recessions that wiped out younger savers.

When the 2008 financial crisis hit, Boomers—already owning homes and stocks—used the crash to buy more assets at discounted prices. Millennials, just entering the workforce, lost jobs and couldn’t participate in the recovery. By 2024, 67% of stock market gains since 2009 went to households over age 55, while those under 35 captured only 8%. This is the boomer wealth monopoly in action: generational advantage compounding over time.

The boomer wealth monopoly is also protected by tax policy. Capital gains taxes—the primary revenue source for wealthy Boomers—are taxed at 20%, while wage income for younger workers is taxed at 22-37%. The 2017 Tax Cuts and Jobs Act, passed by a Boomer-majority Congress, reduced corporate taxes by 40%, inflating stock prices and Boomer portfolios while adding $2.3 trillion to the national debt that younger generations will repay.

The boomer wealth monopoly extends into entitlement programs. Boomers paid an average of $250,000 into Social Security and Medicare over their careers but will receive $550,000 in benefits—a 220% return subsidized by younger workers. Gen X, Millennials, and Gen Z pay 12.4% of their income into Social Security but face projected benefit cuts of 25-30% by 2035 when the trust fund runs dry.

Medicare spending is projected to consume 18% of GDP by 2040, with 75% of those costs attributed to Boomer beneficiaries. Meanwhile, younger workers face insurance premiums 300% higher than what Boomers paid in the 1980s, with deductibles averaging $6,000 compared to $500 for Boomers. This is generational wealth transfer disguised as social insurance.

“They built a system where they take more than they gave, then told us we’re entitled for wanting what they had.”

The boomer wealth monopoly is sustained by political power. Boomers vote at rates 25% higher than Millennials and control 68% of Congressional seats, ensuring policies prioritize their wealth preservation over younger generations’ economic mobility. Proposals to means-test Social Security, increase estate taxes, or fund affordable housing are blocked by Boomer legislators protecting their constituents’ assets.

The boomer wealth monopoly reaches into corporate governance. Boomers hold 72% of Fortune 500 CEO positions and control 81% of corporate board seats, making decisions that prioritize shareholder returns (benefiting Boomer investors) over worker wages. Since 1980, corporate profits have grown 420%, while worker wages increased only 12%. This isn’t capitalism—it’s extraction.

Boomers also control 64% of private equity and venture capital, deciding which industries receive funding and which are starved. Sectors that benefit younger generations—affordable housing development, student debt relief startups, renewable energy—receive 40% less investment than industries that serve Boomer interests like luxury retirement communities and pharmaceutical companies.

The boomer wealth monopoly is maintained through corporate lobbying. Boomer-led industries spent $4.2 billion in 2023 lobbying against rent control, student debt forgiveness, and climate policy—all issues that would reduce their wealth concentration. This isn’t free market competition; it’s rigged governance.

The boomer wealth monopoly is supposed to end with “the great wealth transfer”—but that’s a lie. While $84 trillion in Boomer assets will theoretically pass to heirs, 62% will go to the top 10% of earners, skipping middle and lower-income Millennials entirely. Estate taxes apply only to assets over $13.6 million, meaning 98% of Boomer wealth transfers tax-free, compounding inequality into the next generation.

Additionally, 45% of Boomers plan to spend their wealth on healthcare and long-term care, leaving little for inheritance. Nursing home costs averaging $120,000 annually will consume an estimated $22 trillion in Boomer assets by 2045, reducing the “wealth transfer” to a fraction of current projections. Younger generations won’t inherit their way out of the boomer wealth monopoly—they’ll inherit debt.

Ending the boomer wealth monopoly requires systemic change. Policies must include progressive wealth taxes targeting assets over $10 million, estate tax reform eliminating the stepped-up basis loophole, and means-testing Social Security to reduce benefits for millionaires. Zoning reform must override local Boomer control to allow housing construction, and capital gains taxes must match wage income rates to stop rewarding passive wealth over work.

The boomer wealth monopoly isn’t sustainable. As younger generations control more political power, the policies that built this system will collapse. The question isn’t whether the monopoly will end—it’s whether it ends through reform or economic collapse. Either way, the generation that built this system won’t face the consequences. We will.

The boomer wealth monopoly is generational theft. It’s time to call it what it is and demand accountability.