Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

Student loan debt by generation reveals the full picture: Millennials owe an average of $45,000 while Boomers got nearly free college education.

The federal student‑loan portfolio sits at a staggering $1.6 trillion and is held by roughly 43 million borrowers as of 2024. The average balance per borrower is about $37,000, but anyone who dared to earn a four‑year or graduate degree is now staring at $40,000–$50,000 in debt. The Federal Reserve’s 2023 Report on the Economic Well‑Being of U.S. Households shows that most debtors owe between $20,000 and $59,999, and it’s the Millennials and Gen Z who are glued to the bottom of that range. In short, the system is rigged to make a whole generation foot the bill for a broken education model.

===Key Takeaways

- The total student‑loan mountain is roughly $1.6 trillion, shouldering 43 million borrowers.

- Average debt per borrower hovers around $37,000.

- Four‑year and graduate‑degree holders routinely owe $40,000–$50,000.

- Most borrowers are stuck in the $20,000–$59,999 bracket.

- Younger adults are far more likely to be drowning than their Boomer counterparts.

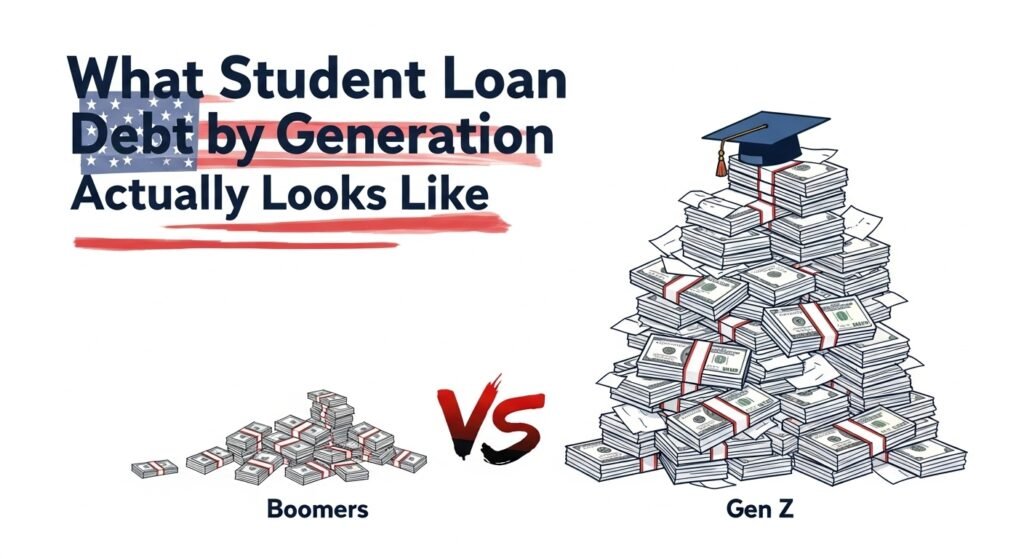

Federal data doesn’t hand us clean labels like “Boomer student loans,” but we do have student loan debt by age, and we know which ages map to which generations. Pew Research Center defines Baby Boomers as born 1946–1964, Gen X as born 1965–1980, Millennials as born 1981–1996, and Gen Z as born 1997–2012. The New York Fed’s Household Debt and Credit reports show that the largest share of student loan balances is held by people in their 30s and 40s—mostly Millennials and younger Gen X. A smaller, but still serious, share is held by those under 30, covering younger Millennials and Gen Z student loans. Older adults, including most Boomers, hold much less of today’s student loan burden.

The student loan debt statistics break down like this in 2025 language: Boomers mostly went to college when tuition was low enough to pay with a part-time job or family help, often with no loans at all. Gen X was the first big cohort to get squeezed by rising costs and shrinking state support, and many still carry gen x student loans into middle age. Millennials hit the full force of the college affordability crisis, sky-high debt, and a recession on graduation. Gen Z is enrolling after tuition has already exploded, watching Millennials drown in payments and wondering if college is even worth it.

That’s the student debt vs Boomer generation story in a sentence: The people who paid the least for college are the loudest about why you shouldn’t get help paying yours off. The New York Fed’s Household Debt and Credit data confirms this pattern year after year. When Boomers lecture about personal responsibility, they’re conveniently forgetting they graduated into an economy where college was cheaper for Boomers than it’ll ever be for us.

===

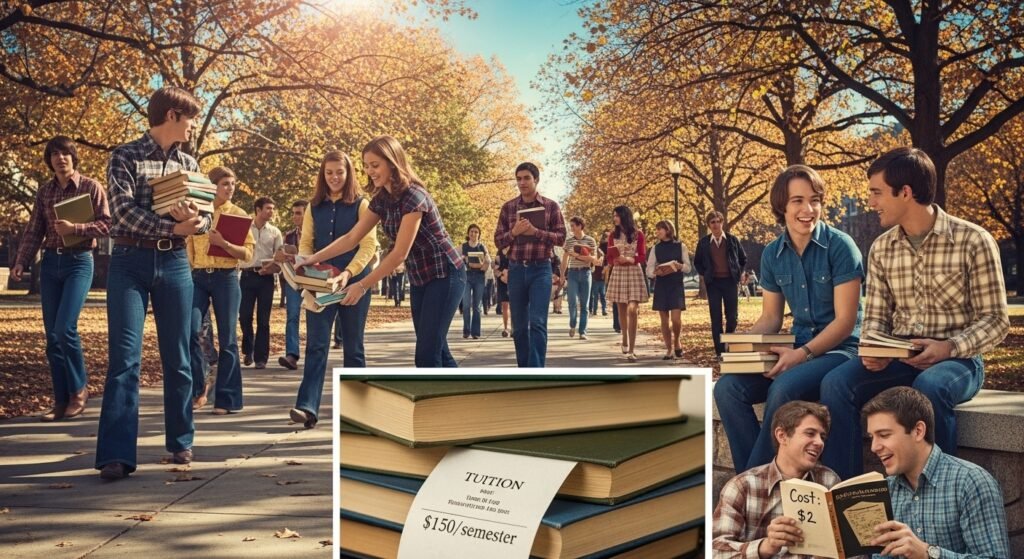

To understand student loan debt by generation, you have to look at boomer college costs. The National Center for Education Statistics (NCES) tracks tuition over time, and the numbers are brutal. At public four-year colleges, average annual tuition and fees in current dollars were roughly $394 in 1970–71, $804 in 1980–81, $1,908 in 1990–91, $3,508 in 2000–01, $7,073 in 2010–11, and $9,375 in 2020–21. When Boomers tell you they “worked their way through school,” this is what they mean in dollar terms. They lived in a world where baby boomer education costs were a rounding error compared to today.

The federal minimum wage tells an even uglier story. In 1970, it was $1.60 per hour. In 2024, it’s $7.25 per hour—unchanged since 2009. Now let’s compare tuition vs minimum wage and watch the working through college myth collapse under basic math.

| Academic Year | Average Public 4‑Year Tuition & Fees (Current $) | Federal Minimum Wage (Nominal $) | Hours at Min Wage to Cover 1 Year Tuition |

|---|---|---|---|

| 1970–71 (Boomer era) | $394 | $1.60 | ~246 hours |

| 1990–91 (Gen X era) | $1,908 | $3.80 | ~502 hours |

| 2010–11 (Millennial era) | $7,073 | $7.25 | ~976 hours |

| 2020–21 (Millennials & Gen Z) | $9,375 | $7.25 | ~1,293 hours |

A Boomer in 1970 could cover a full year of tuition at a public four-year college with around six weeks of full-time work—roughly 246 hours. A Millennial in 2010 would need nearly six months of full-time work—about 976 hours—just for tuition. By 2020, a Millennial or Gen Z student would need well over eight months of full-time minimum-wage work—around 1,293 hours—for that same single year of tuition. And that’s only tuition and fees, with no housing, food, books, or healthcare included.

Boomers could easily work through college because the math actually worked. For Millennials and Gen Z, that myth is dead. The cost of college then vs now isn’t just different—it’s obscene. When someone tries to tell you they paid their way through school, ask them what year they graduated and do the math. Chances are, they’re comparing apples to a financial crisis.

The Bureau of Labor Statistics tracked how fast college tuition and fees have grown compared to overall prices. Between 1980 and the mid-2010s, the price index for college tuition and fees rose by over 1,200%, while the overall Consumer Price Index rose only a few hundred percent. This isn’t just inflation—this is systematic price gouging dressed up as “investment in your future.” The college tuition increase over time has been exponential, while wages for young workers have stayed flat.

That’s what the student loan crisis explained looks like in one chart: Degrees didn’t become 12 times better. Wages didn’t go up 12 times. Only the sticker price of college did. The Bureau of Labor Statistics documented this trend in painful detail, showing how rising tuition costs outpaced nearly every other category of consumer spending. Meanwhile, the quality of education hasn’t improved proportionally—class sizes got bigger, adjuncts replaced tenured faculty, and administrative bloat exploded.

For Millennials entering college in the 2000s and 2010s, this exponential curve meant one thing: debt was the only option. There was no working through school, no paying as you go, no summer job that covered tuition. Just loans, compounding interest, and the promise that a degree would make it all worthwhile. Spoiler alert: it didn’t. The average student debt 2025 reflects decades of this compounding dysfunction, and it’s only getting worse for Gen Z.

Here’s the real answer to why is college so expensive now: defunded state universities. For decades, public colleges were cheap because states actually paid for them. Over time, states shifted the bill from taxpayers to students, and Boomers who benefited from robust public funding voted for the tax cuts and budget cuts that starved those same schools. The State Higher Education Executive Officers Association (SHEEO) tracks this in its State Higher Education Finance (SHEF) reports, and the data is damning.

Educational appropriations per full-time equivalent student at public institutions dropped sharply after the early 2000s, especially after the 2008 recession. As states cut funding, the share of educational revenue coming from tuition rose substantially, making students and families shoulder a much larger share of costs. When Boomers were in school, taxpayers picked up a big share of the tab. When Gen X and Millennials got to campus, legislatures had already gutted funding. Now Gen Z student loans are filling the hole left by state disinvestment.

This is the college affordability crisis in policy terms: Boomers voted for tax cuts and budget cuts that starved public colleges, then told their kids to just “work harder” to afford the degrees that used to be cheap. SHEEO’s State Higher Education Finance data shows this trend state by state, year by year. It’s not a mystery. It’s not an accident. It’s policy, and it’s working exactly as intended—to transfer wealth from young people to older generations who already got theirs.

Let’s ground this in real numbers with a generational debt comparison using what we know from federal and Fed data about which ages hold the most debt. The Federal Reserve reports that adults in their 30s and 40s hold the largest share of student loan balances, with younger adults under 30 also heavily indebted—exactly the age bands covering Millennials and younger Gen X. The Federal Reserve’s 2023 Economic Well-Being report shows that among adults with outstanding education debt, the median amount owed is in the tens of thousands of dollars, and for borrowers with graduate degrees it’s substantially higher.

| Generation (Age in 2025) | Typical College Costs at Enrollment | Debt Situation Now |

|---|---|---|

| Baby Boomers (61–79) | Low tuition, many states with very low or near-free public college | Relatively small share still owe; many paid little or nothing for degrees |

| Gen X (45–60) | Rapidly rising tuition, beginning of heavy reliance on loans | Significant share still repaying; balances often tens of thousands |

| Millennials (29–44) | Peak of tuition inflation and state funding cuts | Largest burden; many owe roughly $40,000–$50,000 each, with some far higher |

| Gen Z (13–28) | Entering college after decades of rising prices | Early borrowers already taking on substantial debt; facing same or worse conditions as Millennials |

So how much student debt do Millennials have? Enough that $45,000 is a painfully realistic “average student debt 2025” talking point for those who finished bachelor’s and especially graduate degrees. Enough that millennial student debt has become the anchor dragging down homeownership, family formation, entrepreneurship, and retirement savings. The student loan burden isn’t evenly distributed—it falls heaviest on the generations who were told education was the key to success, then handed a bill that makes that success nearly impossible.

This is why student loan debt by generation isn’t just an economics topic—it’s a political indictment. Boomers got cheap college, strong unions, affordable housing, and pensions. Millennials and Gen Z got debt, gig economy jobs, a housing crisis, and lectures about avocado toast. The math doesn’t lie, and the hypocrisy is staggering.

Boomer talking points are predictable: “I paid my loans, you should too.” “College was always expensive.” “You chose a bad major.” Reality, backed by student loan statistics by generation and basic math, tells a different story. Wages have not kept up. While tuition shot up over 1,000%, inflation-adjusted wages for young workers barely moved in comparison. The Bureau of Labor Statistics data shows this gap clearly—productivity went up, profits went up, executive pay went up, but worker wages stayed flat.

The student loan burden falls on exactly the generations whose economic lives were wrecked by the 2001 crash, the 2008 financial crisis, and the COVID recession—all before many Millennials hit 40. The National Bureau of Economic Research tracks these business cycles, and they line up perfectly with Millennial life stages: graduating into recession, trying to buy homes during housing crashes, starting careers during downturns. Many Millennials with high average student loan debt weren’t borrowing for “useless” majors—they were borrowing for nursing, teaching, engineering, and graduate degrees employers demanded.

When people ask why Millennials can’t pay off loans, here’s the easy 2025 answer: Because the cost of college exploded, wages stagnated, and the people who benefited from cheap education passed laws that made borrowing the only option—then refused to fix the mess. The millennial financial struggles aren’t about poor choices or laziness. They’re about a system rigged to extract wealth from younger generations and transfer it upward. For more context on how Boomers systematically dismantled the economic ladder they climbed, check out these detailed breakdowns.

To tie student loan debt by generation back to policy, look at the growth of outstanding student loan balances as tracked by the Fed. In the early 1990s, student loan balances were a relatively small slice of household debt. By the 2010s and 2020s, student loans had become one of the largest categories of non-mortgage debt, surpassing credit cards and auto loans. This explosion lines up almost perfectly with the defunding of state universities, the rising tuition costs documented by BLS and NCES, and the period when Gen X, Millennials, and now Gen Z were in college.

That’s not bad luck. That’s design. The student debt crisis is the direct result of policy choices made by politicians—many of them Boomers—who benefited from cheap public education and then dismantled that system for everyone who came after. Student loans grew from a minor category of household debt to a trillion-dollar anchor around the necks of younger generations, and it happened during the exact decades when state funding collapsed and tuition exploded.

Federal Reserve Bank of New York data shows this trajectory clearly: student loans now dominate the debt profiles of Americans under 45, while older Americans who attended college in the Boomer era carry little to no education debt. This isn’t a coincidence. It’s the direct outcome of decades of policy failures, all dressed up as “personal responsibility” by the same people who got theirs for cheap and pulled up the ladder behind them.

The loudest voices against student debt forgiveness tend to be the same Boomer politicians and commentators who attended cheap or nearly free public universities, benefited from robust state funding, graduated into a labor market without three major recessions in 20 years, and then helped pass the tax cuts and budget cuts that defunded those same schools. Meanwhile, Millennials and Gen Z are told the best way to get ahead is a degree, charged 10–20 times what Boomers paid, then blamed for millennial financial struggles when the math doesn’t work.

If you want a clear, easy political takeaway for 2025, here it is: The student loan crisis is not a moral failure of borrowers. It’s a policy failure—engineered over decades—that shifted the cost of public education from the generation that built wealth to the generations already drowning in debt. Fixing it requires serious student debt forgiveness and reform of existing balances, rebuilding public funding for colleges so future students don’t need to borrow this much, tying tuition policy to wages and public investment instead of admin bloat and private profit, and treating higher education as a public good the way it effectively was when Boomers went through school.

Until that happens, student loan debt by generation will keep telling the same ugly story: College was cheaper for Boomers. Gen X got squeezed. Millennials and Gen Z got sold a lie, financed with debt. And the bill—roughly $45,000 per Millennial borrower in many cases—is the price of that hypocrisy. For those tracking how these policies systematically destroyed economic opportunities for younger Americans, explore more detailed analysis of the generational wealth transfer that’s been happening for decades.

We didn’t ask for this system. We didn’t design it. We didn’t vote to defund our own educations. Boomers did that, and now they’re lecturing us about responsibility while sitting on the wealth they extracted from a system that no longer exists. The data doesn’t lie, the math is brutal, and the accountability needs to start now. Student loan debt by generation isn’t just a statistic—it’s a receipt for decades of policy failure, and we’re the ones stuck paying it.

===Sure, you could say “you signed the loan, you pay it back,” as if every Millennial walked into a tuition‑free wonderland and chose to borrow $45,000 for a piece of paper. That narrative conveniently ignores the fact that tuition has been inflating faster than a meme stock, state universities have been starved of funding, and the federal government has handed out loans like candy while pretending it’s a merit‑based system.

The reality is that policy, not personal laziness, built the debt avalanche. When the system forces you to borrow half a year’s salary just to get a degree, blaming “personal responsibility” is not only lazy—it’s a smokescreen for the generational theft orchestrated by the very politicians who now lecture you about fiscal prudence.

===We’re looking at a $1.6 trillion mountain of debt spread across 43 million borrowers, with the average balance sitting near $37,000. For degree‑holders, the number jumps to $40,000–$50,000.

Boomers paid for college when tuition was a fraction of today’s price and many public schools were fully funded. Millennials inherited a system that forces them to borrow massive sums just to keep up, turning a once‑affordable credential into a financial time‑bomb.

Real solutions require massive debt forgiveness, a rebuild of public college funding, and tuition policies tied to wages—not to private profit. Until policymakers stop treating education like a cash‑cow, the debt will keep choking the next generation.

Check out our deep‑dive series on the subject, starting with Boomer Wealth Monopoly: How One Generation Hoarded America’s Resources for the full backstory.

The figures come from the Federal Reserve’s 2023 Report on the Economic Well‑Being of U.S. Households (PDF) and the U.S. Department of Education’s Federal Student Aid data (Data Center). Additional context is drawn from our own investigative series on generational wealth theft.