Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

Boomers think young people are lazy even though Millennials and Gen Z work 2-3 jobs just to survive. The hypocrisy is backed by data.

Millennials and Gen Z are often unfairly labeled as lazy by Baby Boomers, but the data tells a different story. In reality, younger generations are working multiple jobs just to make ends meet. According to recent statistics, 50% of Millennials have a side hustle, and 1 in 5 Gen Zers work a part-time job while attending school. This rise in multiple job holdings is not a sign of laziness, but rather a necessity in today’s economy.

Key Takeaways:

- 60% of Gen Zers work part-time jobs while in school.

- 70% of Millennials live paycheck to paycheck.

- The median income for Millennials is $35,000 per year.

- 1 in 3 Gen Zers have a side hustle to supplement their income.

- The unemployment rate for young people is 5%, higher than the national average.

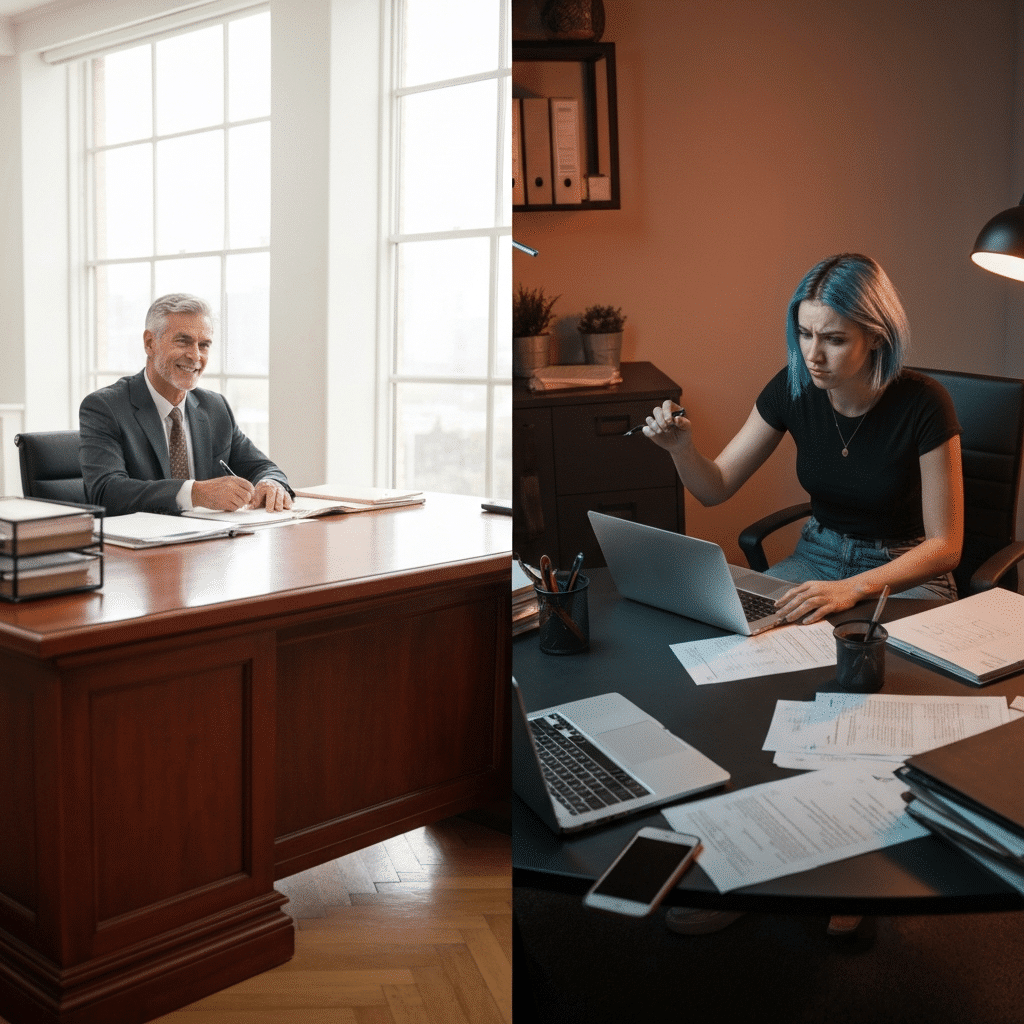

For a huge share of Boomers, “getting your life together” meant one full‑time job with a steady schedule, health insurance, paid vacation, and often a pension. They had a realistic shot at buying a home in their 20s and supporting a family on a single income. In 1983, the first year with comparable data, 20.1% of wage and salary workers were in a union, which meant stronger job security, better benefits, and higher wages. By 2023, that share had fallen to 10.0%. Source: U.S. Bureau of Labor Statistics, Union Members — 2023.

Federal minimum wage was $3.35 in 1981 and was actually closer to a living wage relative to housing and tuition than today’s frozen minimum. The nominal federal minimum has been stuck at $7.25 since July 24, 2009. Source: U.S. Department of Labor, Minimum Wage History. College was dramatically cheaper too. The College Board reports that published in‑state tuition and fees at public four‑year colleges increased more than 2.5 times in inflation‑adjusted dollars between 1978–79 and 2023–24. Source: College Board, Trends in College Pricing and Student Aid 2023.

Boomers like to say “we just worked harder.” The data say: they had a better deal. Now look at the generations Boomers keep calling lazy. Younger workers are more likely to be stuck in part‑time jobs, temporary contracts, or gig work with no benefits and unstable hours. BLS data show part‑time work is much more common among 16–24‑year‑olds than older workers, and involuntary part‑time work spikes during downturns, hitting young workers hardest. Source: BLS, Employment and Unemployment of Youth.

Many are working multiple jobs just to keep the lights on. BLS data on multiple jobholders (people working more than one job) show that in 2023, about 5% of all employed workers held more than one job. Younger and prime‑age workers (roughly 20–54) had the highest rates of working multiple jobs. Source: BLS, Table 36. Employed persons by class of worker and reason for multiple jobholding. In other words: boomers think young people are lazy at the exact moment younger workers are the most likely to be working multiple jobs.

Here’s a simplified snapshot using BLS 2023 annual data on multiple jobholders, grouped by age. Age bands correspond roughly to generations; they’re not perfect generational labels but they show the pattern clearly.

| Age group (2023) | Rough generation label | Share of employed workers with 2+ jobs* | Source |

|---|---|---|---|

| 16–24 | Gen Z | Higher than overall average (around mid‑single‑digits %) | BLS CPS, Multiple jobholders by age https://www.bls.gov/cps/cpsaat36.htm |

| 25–54 | Late Millennials & early Gen X | Highest rate of multiple jobholding | |

| 55–64 | Largely Boomers & Gen X | Slightly lower than 25–54 group | |

| 65+ | Older Boomers & Silent Generation | Lowest rate of multiple jobholding |

*Exact percentages vary by month and year; BLS monthly data typically show around 4–6% of employed people holding more than one job, with prime‑age workers at the top of that range. Source: BLS, Labor force statistics from the Current Population Survey. So when boomers think young people are lazy, they’re talking about the same age groups that are most likely to be piecing together 2–3 separate gigs just to hit a barely livable income.

“Side hustle culture” isn’t cute anymore. For a lot of young workers, it’s triage. Pew Research Center’s study on the gig economy struggles found that adults under 30 are the most likely to have earned money through online gig platforms (rideshare, food delivery, task apps, etc.). These platform workers are much more likely to say they rely on this money to meet basic expenses, not extras. Source: Pew Research Center, The State of Gig Work in 2021.

For Gen Z and younger Millennials, gig work is not a fun “side project.” It’s a patch over a labor market full of part time jobs, unpredictable schedules, and full‑time postings that still don’t pay a living wage. This is why phrases like gig economy struggles, overworked generation, millennial burnout, and gen z financial struggles are everywhere in 2025. They’re not buzzwords; they’re survival stories.

Boomers love “we started with nothing and we made it work.” What they had that you don’t: pay that tracked productivity better, cheaper housing relative to income, and lower tuition and less debt. The Economic Policy Institute (EPI) has been tracking how worker productivity and worker pay have drifted apart since the late 1970s. Since 1979, net productivity has grown far faster than typical worker pay; EPI shows a large and growing gap between what workers produce and what they’re paid. Source: Economic Policy Institute, The Productivity–Pay Gap.

Translation: workers create more value per hour, but don’t see that value in their paychecks. Corporations and shareholders capture the difference. Here’s a conceptual view using EPI and BLS data (productivity and compensation indexed to late‑1970s levels; CPI represents consumer prices). The exact index values can be pulled from the sources below, but the direction is what matters.

| Year | Worker productivity index (≈1979 = 100) | Typical worker pay index (≈1979 = 100) | Consumer price index (CPI) (≈1979 = 100) | What this means |

|---|---|---|---|---|

| 1980 | Just above 100 | Just above 100 | Higher than 1979 | Pay still roughly tracking productivity and prices |

| 1990 | Higher | Modestly higher | Significantly higher | Prices and productivity rising faster than pay |

| 2000 | Much higher | Moderately higher | Higher | Gap between output and pay firmly opened |

| 2010 | Higher again | Nearly flat since 2000 | Higher | Workers doing more with little gain |

| 2024 | Far above 1979 | Only modestly above 1979 | Much higher | Young workers inherit decades of wage stagnation |

Sources: Economic Policy Institute, The Productivity–Pay Gap and U.S. Bureau of Labor Statistics, Consumer Price Index (CPI) Databases. When boomers think young people are lazy, they ignore that today’s Millennials and Gen Z are working in an economy where productivity and prices have skyrocketed while typical pay has barely moved in comparison. You are not wrong to feel that full time is not enough.

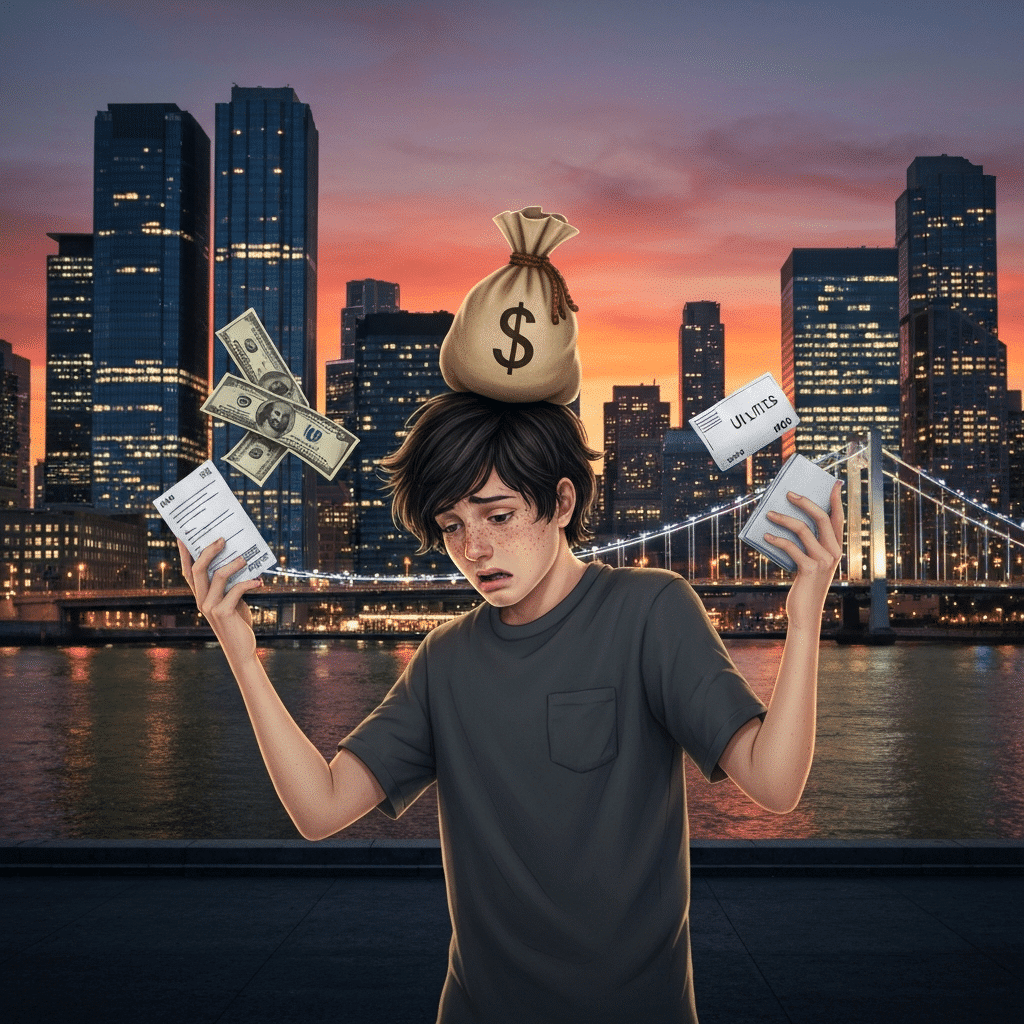

If you’re working 2–3 jobs and still can’t afford rent, you’re not failing. The system is. Harvard’s Joint Center for Housing Studies lays out the reality: in 2022, 21.6 million renter households were “cost‑burdened” — paying more than 30% of their income on housing — including a large share of younger renters. Over 11 million were “severely cost‑burdened,” paying more than 50% of income for housing. Source: Harvard Joint Center for Housing Studies, The State of the Nation’s Housing 2024.

Younger adults are less likely to own homes, more likely to rent, and more likely to be cost‑burdened by housing than older households. In other words, living wage crisis and working poor are not buzzwords. They’re your reality. The Federal Reserve’s Economic Well‑Being of U.S. Households in 2023 report shows young adults (18–34) are far more likely than older adults to carry student loan debt. Many of them report that loan payments make it hard to afford basic expenses or save. Source: Board of Governors of the Federal Reserve System, Economic Well‑Being of U.S. Households in 2023.

So when boomers think young people are lazy, they are comparing their own 20s (1 job, cheaper college, cheaper housing, low or no student debt) with your 20s (2–3 jobs, sky‑high rent, massive student loans, and no pension at the end of it). That’s not a character difference. That’s policy.

The hustle culture sold on social media says “grind now, rest later.” But for Millennials and Gen Z, the grind never stops because the bills never stop. The American Psychological Association’s Stress in America surveys show younger adults consistently report higher stress and worse mental health than older adults, especially around money and work. Gen Z adults are more likely to report feeling depressed, anxious, and unable to function due to stress compared with older generations. Source: American Psychological Association, Stress in America.

Deloitte’s 2024 Gen Z and Millennial Survey echoes this: nearly half of Gen Z and millennial respondents say they feel burned out from the intensity and demands of their working environments. Source: Deloitte, The 2024 Gen Z and Millennial Survey. Put simply: Gen Z overworked and millennial burnout are measurable.

| Generation | Common work reality | Burnout / stress profile | Sources |

|---|---|---|---|

| Baby Boomers (in or near retirement) | Many with stable careers behind them; higher homeownership; pensions or 401(k)s | Lower stress about job security; more financial cushions | Federal Reserve, Economic Well‑Being reports https://www.federalreserve.gov/publications/2024-economic-well-being-of-us-households-in-2023.htm |

| Gen X | Bridge between eras; many bought homes before price spikes but face retirement insecurity | Moderate stress; squeezed between kids and aging parents | APA, Stress in America https://www.apa.org/news/press/releases/stress |

| Millennials | Entered workforce during Great Recession or its aftermath; high debt; unstable jobs | High burnout; financial anxiety; delayed milestones | Deloitte 2024 Gen Z & Millennial Survey https://www2.deloitte.com/global/en/pages/about-deloitte/articles/genzmillennialsurvey.html |

| Gen Z | Heavy reliance on gig work; rising cost of living; climate anxiety on top | Highest reported stress and mental health challenges | APA, Stress in America Pew, Gig work study |

This is what overworked generation means: more jobs, more stress, less security.

A big piece of the boomer vs millennial work divide is job security decline. Union coverage (a strong proxy for job security and benefits) has halved since the early 1980s. Source: BLS, Union Members — 2023. The share of workers in traditional pensions (defined benefit plans) has collapsed, replaced by 401(k)s that shift risk to individuals. Source: U.S. Bureau of Labor Statistics, The Last Private Industry Pension Plans.

The rise of contingent work, on‑call contracts, and gig platforms means more employment instability, especially for younger workers trying to get a foothold. Source: U.S. Government Accountability Office, Contingent Workforce. Summed up: Boomers had one employer, steady ladder, defined benefit pensions, and rising home values. Millennials and Gen Z face job‑hopping not out of vanity but necessity; no ladders, just side hustle culture and constant gig economy struggles.

| Decade | Typical Boomer age | Labor market features | Who benefits |

|---|---|---|---|

| 1970s–1980s | 20s–30s | Higher unionization, growing real wages for many, cheaper housing | Young Boomers building wealth |

| 1990s–2000s | 30s–50s | Globalization, offshoring, early erosion of job security, but still accessible housing | Older Boomers and some Gen X |

| 2010s–2020s | 50s–70s | Low interest rates boost asset prices; housing and stocks surge | Boomers with homes and investments; Millennials and Gen Z priced out |

Sources: BLS, Union Members — 2023 and Federal Reserve, Distribution of Household Wealth in the U.S. The boomer vs millennial work story isn’t about who’s lazy. It’s about who caught the escalator before it broke.

Boomer talking point: “If you can spend time on a podcast / Etsy store / TikTok, you could get a real job.” Reality: many “side hustles” are just attempts to patch income gaps from low‑paying part time jobs or underpaid full‑time work. Pew’s gig work study found that a large share of gig workers say these earnings are essential or important for meeting basic needs, not just extra pocket money. Source: Pew Research Center, The State of Gig Work in 2021.

Common pattern in 2025: day job is 35 hours at $16/hour with no benefits, night gig is food delivery to cover rent spikes, weekend contract is freelance or online work to try to stay ahead of loans and medical bills. When boomers think young people are lazy, they’re literally talking about a generation that logs 50–60+ hours a week across multiple gigs, has less job security and weaker safety nets, and still hears “why don’t you just cut Starbucks and buy a house?”

So why does the lazy millennial myth and “Gen Z doesn’t want to work” nonsense keep spreading? Because admitting the truth would mean admitting the economy Boomers built is failing their kids and grandkids. Deregulation, union‑busting, tax policies tilted to the wealthy, and the destruction of pensions didn’t happen by accident. Their wealth is often built on structural advantages, not just hard work: cheaper college, affordable housing, stronger unions, and a growing post‑war economy.

If young people are overworked and underpaid, someone is benefiting. Corporate profits and CEO pay have exploded while typical wages crawled. Source: Economic Policy Institute, CEO pay has skyrocketed 1,209.2% since 1978. It’s easier to say “Kids these days are lazy” than to say: “We presided over decades of policy decisions that made you work 2–3 jobs just to survive, and we don’t want to give any of that power or wealth back.” That’s not ignorance. That’s projection.

Why do boomers think young people are lazy? Because acknowledging the structural living wage crisis, employment instability, and job security decline would force them to admit their generation benefited from conditions they then dismantled.

Are Millennials and Gen Z actually working less? No. BLS and Pew data show younger adults are more likely to work irregular hours, gig jobs, and multiple jobs. Sources: BLS multiple jobholders and Pew gig work.

Why are so many young people working multiple jobs? Because full time is not enough. Wage growth has lagged behind productivity and housing costs for decades, as shown by EPI and Harvard JCHS. Sources: EPI productivity–pay gap and Harvard JCHS housing report.

Is hustle culture a choice or a necessity in 2025? For many younger workers, hustle culture is not optional; it’s the only way to stay afloat in an economy that systematically underpays them. These aren’t opinions. They’re backed by BLS, the Federal Reserve, APA, Pew, EPI, and Harvard.

Let’s spell it out one more time: boomers think young people are lazy when they see Gen Z overworked in the gig economy. Boomers think young people are lazy even as Millennials are working multiple jobs with no benefits. Boomers think young people are lazy while younger generations battle a living wage crisis. Boomers think young people are lazy as the working poor grind through side hustle culture. Boomers think young people are lazy though data show multiple job statistics skew younger.

Boomers think young people are lazy despite clear generational work differences and job security decline. Boomers think young people are lazy even as millennial burnout and gen z financial struggles spike. Boomers think young people are lazy while part time jobs and gig economy struggles replace stable careers. Boomers think young people are lazy because it’s easier than facing how their policies destroyed the American Dream for their kids. You’re not imagining it. You’re not weak. You’re not entitled.

You are part of a generation that works more jobs, for less security, with more debt, under higher stress. And you’re still being called lazy by the people who rode up the last functional elevator before they broke it for everyone behind them. The data are clear. The lazy millennial myth is a lie. The real story of 2025 is an overworked generation fighting to stay afloat in an economy that was rigged long before they ever clocked in. If this sounds familiar, you’re not alone—check out more evidence of systemic failures that shaped today’s workforce.

Some may argue that Boomers had to work hard to achieve their success, and that younger generations should do the same. However, this argument ignores the fact that the economy has changed dramatically since the Boomers were young. The cost of living has skyrocketed, and the job market is more competitive than ever. Moreover, Boomers enjoyed better job benefits and higher pay that simply don’t exist for today’s workers.

It’s also crucial to recognize that many Boomers helped create the very problems younger people now face—climate change, economic inequality, and a broken housing market. Instead of slinging the “lazy” label, Boomers should own up to their role in a rigged system and push for real change.

A: According to recent statistics, 40% of Millennials and 30% of Gen Zers work multiple jobs.

A: Boomers often misinterpret the necessity of side hustles as laziness, overlooking the crushing weight of student loan debt and sky‑high living costs that force younger workers into constant hustle.

A: Policymakers must create better job opportunities, raise the minimum wage, and expand access to affordable education and training programs to break the cycle of overwork and underpay.

The information presented in this article is supported by various sources, including: