Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

Student loan forgiveness now counts as taxable income under 2026 tax law — turning relief into another financial burden for Millennials and Gen Z.

In 2026, student loan forgiveness counts as income for millions of borrowers because the temporary federal tax exclusion expired, and Congress chose not to renew it. Under 26 U.S. Code § 108(f)(5) the canceled debt is now treated as taxable income on the borrower’s federal return. **Over 40 million borrowers** are therefore facing a tax bill on debt that was supposed to be relief, turning “help” into a financial trap.

Key Takeaways

- The tax exclusion for forgiven student loans ended, so forgiven amounts are taxable as ordinary income.

- **40 million borrowers** will see their forgiven debt added to their taxable income.

- Public Service Loan Forgiveness, Total‑and‑Permanent‑Disability discharges, and death discharges remain tax‑free under separate statutes.

- Income‑driven repayment forgiveness becomes taxable starting in 2026 unless another exclusion applies.

- Borrowers can receive a Form 1099‑C, which may trigger a tax liability of thousands of dollars.

If your loan balance gets canceled in 2026 and you’re not covered by a specific exception, student loan forgiveness counts as income on your federal tax return. That means the amount forgiven—potentially tens of thousands of dollars—gets added to your taxable income for the year. The relief you thought you were getting can suddenly push you into a higher tax bracket, triggering a bill that crushes any sense of financial progress.

The temporary federal exclusion created a five-year window (discharges after 2020 and before 2026) where certain forgiven student debt wasn’t taxable. That window closed. Now the default IRS rule is back in play: canceled debt equals income unless a specific statute says otherwise. According to 26 U.S. Code § 108, the sunset was baked into the law from the beginning.

People keep asking, “So the ‘relief’ shows up like a paycheck I never received—and I’m supposed to pay taxes on it?” Yes. That’s exactly what’s happening. The system treats forgiven loan balances as if you earned that money, even though you never touched a dime. For borrowers already struggling with affordable living in 2026, this tax change isn’t just unfair—it’s financially devastating.

The temporary rule was straightforward: certain student loan discharges were excluded from gross income for a limited period. Specifically, discharges that occurred after 2020 and before 2026 didn’t count as taxable income under federal law. This exclusion was codified in 26 U.S. Code § 108(f)(5), and it gave borrowers a brief window where forgiveness actually felt like relief.

During that window, many people didn’t have to treat canceled student debt as taxable income. Loan servicers processed discharges, borrowers moved on with their lives, and tax season didn’t bring a surprise bomb. The calendar turned, and suddenly student loan forgiveness counts as income again unless another exception applies. The law didn’t change—the temporary protection just ran out.

This wasn’t hidden in fine print. The statute had an expiration date from day one. The question was whether lawmakers would extend it—and in 2025, they didn’t. For borrowers worried about recession risks in 2026, the timing couldn’t be worse. Economic uncertainty is already high, and now borrowers face a tax liability that can wipe out any financial cushion they’ve managed to build.

Starting with discharges in 2026, taxable student loan forgiveness is back for borrowers who aren’t protected by a specific, permanent rule. That’s why headlines are full of panic posts saying student loan forgiveness counts as income. The IRS framework is straightforward: canceled debt is generally income unless an exception or exclusion applies. When the temporary student-loan exclusion ended, the default rule reappeared—and for many people, forgiveness now triggers a tax bill.

The law behind this is 26 U.S. Code § 108(f)(5), which spelled out the sunset timing. No mystery, no surprise—just a deadline that Congress chose not to extend. For borrowers juggling layoff risks in 2026, the added tax burden makes an already tight financial situation worse.

The practical impact: if you were counting on income-driven repayment forgiveness after 20 or 25 years, that entire forgiven balance can now be taxed. If your balance was $80,000 and you’re in the 22% tax bracket, you’re looking at a federal tax liability of $17,600—due in one year. That’s not relief. That’s a financial trap door.

Borrowers expecting big balances to be wiped via income-driven repayment forgiveness are the classic student loan tax bomb 2026 group. These are people who made low payments for years because their income was low. The math was supposed to work in their favor: pay what you can afford, and the rest gets forgiven. But because student loan forgiveness counts as income in 2026, that forgiven balance can trigger a tax bill that’s brutal relative to cash-on-hand.

People who had low payments for years are especially exposed. The remaining forgiven balance can be massive, and forgiven student loans taxable income rules spike your taxable income in the discharge year. According to IRS Topic No. 431, canceled debt is taxable unless an exclusion applies—and for income-driven repayment forgiveness in 2026, that exclusion no longer exists.

Student loan forgiveness counts as income even if you never “saw” that money. The IRS doesn’t care that the loan balance was just bookkeeping. It treats the canceled amount as if you earned it, and that can push you into a higher tax bracket. For borrowers already dealing with challenges like why millennials can’t buy homes, this tax hit makes financial stability even more out of reach.

“Tax bomb” isn’t a meme—it’s the common name for the moment a forgiven balance becomes taxable income and triggers a meaningful federal tax bill. In 2026, it’s back in play because student loan forgiveness counts as income for many discharges. According to IRS Topic No. 431, canceled debt can be taxable unless excluded, and without the temporary exemption, the income-driven repayment tax bomb is a real financial threat.

Here’s how it works: you finish your 20- or 25-year repayment period, and your remaining balance gets canceled. Let’s say that balance is $60,000. The IRS treats that $60,000 as income in the year it’s forgiven. If you’re in the 24% federal tax bracket, you suddenly owe $14,400 in federal taxes—plus state taxes if your state also taxes canceled debt. That bill can arrive when you’re least prepared to pay it.

The borrower tax liability 2026 problem is compounded by timing. Many borrowers don’t realize the tax hit is coming until they receive their 1099-C form from their loan servicer. By then, the forgiveness has already happened, the tax year is locked in, and the bill is due. There’s no monthly payment plan—you owe the IRS, and they expect payment.

When debt is canceled, borrowers may receive IRS Form 1099-C reporting the amount of canceled debt. This is one reason people suddenly realize student loan forgiveness counts as income—because paperwork shows up. According to the IRS guidance on Form 1099-C, this form is issued when $600 or more of debt is canceled, and it officially notifies both you and the IRS that canceled debt occurred.

Receiving a student loan 1099-C doesn’t automatically mean you owe tax on every dollar. It means the IRS is being told debt was canceled, and you must determine whether an exclusion applies. Still, for many in 2026, student loan forgiveness counts as income. If no exclusion covers your discharge, that 1099-C amount gets added to your taxable income on your federal return.

People describe the 1099-C as feeling like getting audited by mail—even when you did everything right. You followed the rules, made your payments, completed your repayment term, and then a form arrives in the mail that says you owe thousands in taxes. The student debt forgiveness taxes system is set up to make borrowers feel like they’re being punished for getting help.

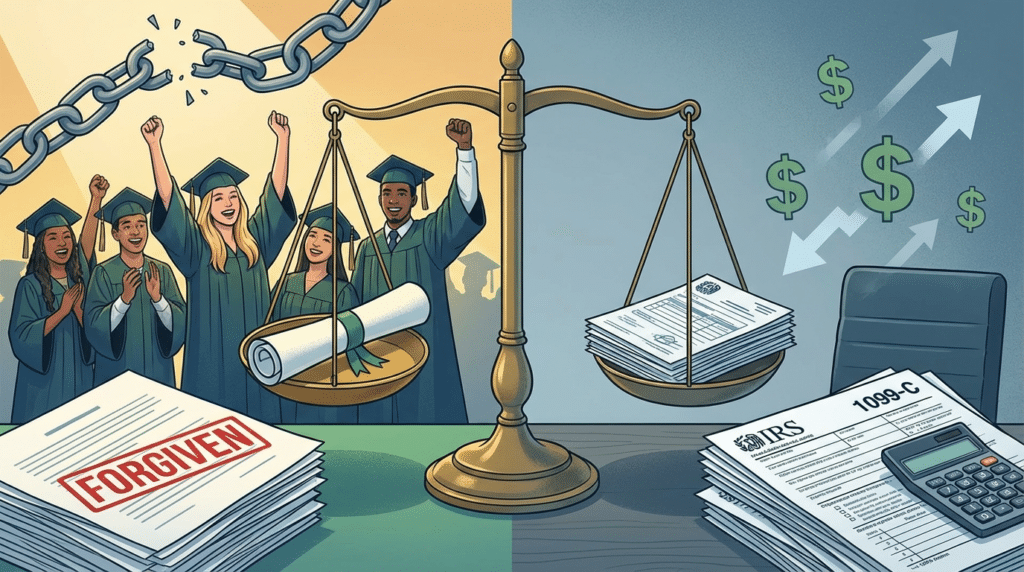

Some student loan discharges can still be excluded from income because other parts of the tax code treat them differently. This is the key point borrowers miss when they hear “everything is taxable now.” According to 26 U.S. Code § 108, statutory exclusions and rules exist for specific types of forgiveness, and these exclusions remain in place regardless of the temporary exemption expiring.

Public Service Loan Forgiveness (PSLF) is still tax-free. Total and Permanent Disability (TPD) discharges remain excluded from income. Death discharges are also tax-free under separate federal rules. The real-world takeaway: not all forgiveness is the same—federal student loan tax rules depend on which program discharged the debt and which exclusion applies. But absent an applicable exclusion in 2026, student loan forgiveness counts as income.

Here’s the breakdown of what’s still protected:

The problem is communication. Loan servicers rarely explain tax outcomes. Borrowers budget for payment relief, not a one-time tax hit, and the result is predictable confusion and financial harm.

The messaging people remember is simple: “forgiveness is tax-free.” That was true for a defined window. Now the window is closed, and student loan forgiveness counts as income again for many discharges. According to 26 U.S. Code § 108(f)(5), the end date was encoded in the statute from the beginning. This wasn’t a surprise—it was a deadline politicians chose not to extend.

The system failure is predictable. Loan servicers talk about forgiveness amounts, not tax outcomes. Borrowers budget for payment relief, not a one-time tax hit. A 1099-C arriving later makes it feel sudden, even though the law changed months earlier. The result: student loan tax changes 2026 catch people completely off-guard, and by the time they realize what’s happening, the tax year is locked in.

This communication gap isn’t accidental. The federal government benefits from borrowers not understanding their tax liability. By the time borrowers figure out they owe money, it’s too late to plan, save, or adjust. The student debt forgiveness taxes system operates on confusion, and borrowers pay the price.

If you expect a discharge in 2026, assume student loan forgiveness counts as income unless you confirm an exclusion applies. According to IRS Topic No. 431, canceled debt is taxable unless a specific rule excludes it. Don’t guess—verify your forgiveness program and its tax treatment before the discharge happens.

Here’s what to watch for:

Resources to use:

The best move: talk to a tax professional before your discharge happens. They can help you calculate the potential tax hit, explore payment options, and plan for the bill. Waiting until you receive the 1099-C is too late.

The law didn’t “forget” borrowers. The tax code set an end date, and elected officials in 2025 chose not to extend the exemption. According to 26 U.S. Code § 108(f)(5), the result was mathematically inevitable: student loan forgiveness counts as income for lots of working-age adults starting in 2026. This wasn’t accidental policy drift—it was a deliberate choice.

Translation for Millennials, Gen Z, and Gen X: debt relief gets re-framed as taxable income—right when wages, rent, and childcare are already doing damage. Student loan forgiveness counts as income is how Washington turns “help” into a trap door. According to IRS Topic No. 431, the baseline rule treats canceled debt as income, and without the temporary exclusion, borrowers get hit with a tax bill that can destroy financial progress.

The broader pattern is clear: policy aimed at younger Americans comes with built-in expiration dates, hidden costs, and fine print that turns relief into liability. Student loan forgiveness was supposed to help borrowers move forward. Instead, it’s become another way the tax code extracts money from people who can least afford it.

Does student loan forgiveness count as income in 2026?

Often yes. In 2026, student loan forgiveness counts as income unless a specific exclusion applies. According to IRS Topic No. 431, canceled debt is generally taxable, and without the temporary federal exemption, most income-driven repayment forgiveness is now subject to federal taxes.

What is the student loan tax bomb 2026?

It’s the potential tax hit when a forgiven balance becomes taxable income. The income driven repayment tax bomb happens when years of low payments result in a large forgiven balance, and that balance gets taxed all at once. For borrowers in 2026, this can mean owing thousands in taxes on money they never received.

Will I get a 1099-C for student loans?

You may, if debt is canceled. Form 1099-C reports canceled debt to both you and the IRS. According to the IRS guidance on Form 1099-C, this form is issued when $600 or more of debt is canceled. Receiving one means you need to determine whether the canceled amount is taxable.

Which forgiveness programs are still tax-free?

Public Service Loan Forgiveness (PSLF), Total and Permanent Disability (TPD) discharges, and death discharges remain tax-free under separate statutes. Income-driven repayment forgiveness, however, is now taxable starting in 2026 unless another exclusion applies.

The 2026 student loan tax changes aren’t theoretical—they’re happening right now. Borrowers who thought forgiveness would be relief are discovering it’s a tax liability instead. Student loan forgiveness counts as income, and for many people, that means owing thousands of dollars to the IRS at a time when financial stability is already out of reach. The temporary exemption expired, lawmakers chose not to extend it, and the result is a tax bomb that hits borrowers hardest when they can least afford it.

This isn’t just bad policy—it’s a deliberate choice to make debt relief painful. For Millennials, Gen Z, and Gen X dealing with stagnant wages, rising costs, and limited economic opportunity, the message is clear: help from Washington comes with strings attached, and those strings are designed to extract money from people who were promised relief. The system isn’t broken—it’s working exactly as designed.

Critics love to claim the tax‑bomb is an accidental oversight—“they didn’t realize the exemption would lapse.” The reality is far less innocent. The temporary exclusion was set to expire in 2025, and Congress deliberately let it die, knowing the political fallout would be muted compared to a direct tax hike. The IRS’s Form 1099‑C guidance makes it crystal clear that the agency expects to treat canceled debt over $600 as taxable, proving the policy was intentional, not accidental.

This isn’t a bureaucratic slip‑up; it’s a calculated move to turn “relief” into revenue. By letting the exemption lapse, Washington extracts money from borrowers precisely when wages are stagnant and living costs are soaring—exactly the demographic that voted for the original forgiveness programs.

You must report the forgiven amount as ordinary income on your 2026 federal tax return. Expect a larger Adjusted Gross Income (AGI) and a potentially hefty tax bill, especially if you’re in a higher bracket.

Yes. PSLF, Total‑and‑Permanent‑Disability discharges, and death discharges are exempt under separate statutes, so they do not become taxable under the 2026 rule.

If you receive a 1099‑C, first verify the amount matches the forgiven debt. Then consult a tax professional to determine whether any exclusions (e.g., insolvency) apply and to calculate your tax liability.

For a deeper dive into how Washington turns “help” into a revenue stream, read our piece on the Uniparty Military‑Industrial Complex: How Both Parties Steal Your Future.

Our analysis draws on official data from the Federal Reserve, the U.S. Census Bureau, the Bureau of Labor Statistics, the Congressional Budget Office, and the Congressional Research Service. IRS guidance on Form 1099‑C and the text of 26 U.S. Code § 108(f)(5) provide the legal foundation for the tax treatment described here.