Breaking News

Popular News

Enter your email address below and subscribe to our newsletter

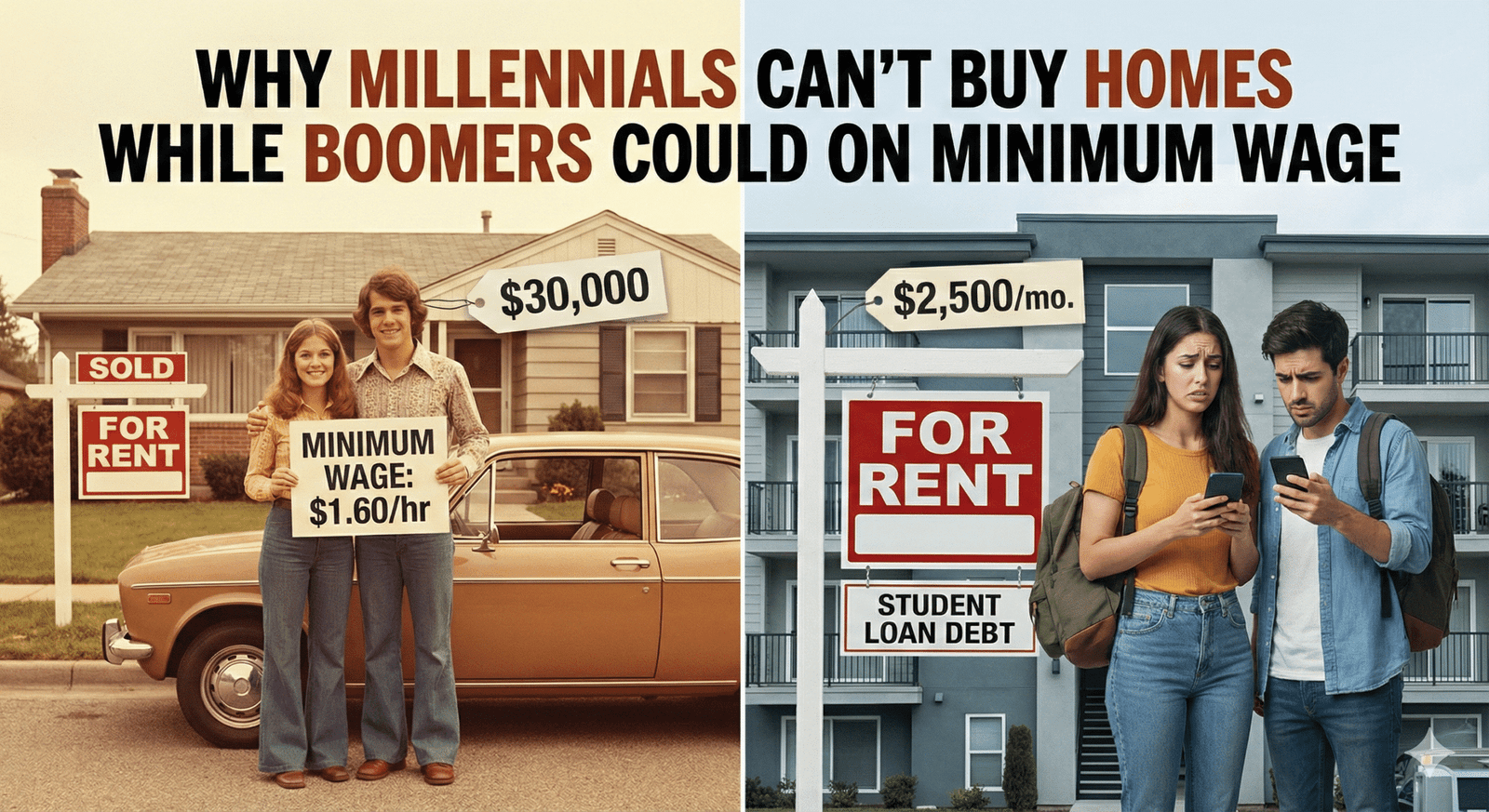

Why millennials can't buy homes while Boomers could on minimum wage. The housing market was deliberately rigged through zoning, policy, and greed.

The median home price in 2022 was **5.6 times higher** than median household income—the highest ratio ever recorded, according to Harvard’s Joint Center for Housing Studies. In the 1970s, houses cost around **$26,650** while average wages were **$7,133**. This stark contrast explains why millennials can’t buy homes while boomers could on minimum wage. The housing‑market math simply doesn’t work anymore.

– KEY TAKEAWAYS ===Key Takeaways

- The median home price is now **5.6 times higher** than median household income.

- In the 1970s the average home was **$26,650** and average wages **$7,133** – a ratio that actually allowed purchase.

- Millennial homeownership sits at **47 %**, versus **61 %** for boomers.

- **53 %** of millennials carry student‑loan debt, a major barrier to buying a house.

- The average student‑loan balance for millennials is **$31,300**.

The numbers explaining why millennials can’t buy homes are stark. A minimum wage worker in 1970 earned $1.45 per hour, or about $3,000 annually. With houses averaging $27,000, it would take roughly 9 years of minimum wage income to buy one outright. Difficult, but mathematically possible with aggressive saving.

Today’s minimum wage sits at $7.25 per hour, bringing in about $15,080 annually. The average house? Over $300,000. That’s more than 20 years of gross income just for the purchase price, not counting the need to eat, pay rent, and live while supposedly saving.

What the housing affordability crisis looks like today:

Someone making $18 an hour today—more than double minimum wage—would need to save for over a decade to afford a 20% down payment on a $300,000 house. Even then, qualifying for the mortgage with current debt-to-income requirements presents another massive hurdle. This is why millennials can’t buy homes at anywhere near the rate previous generations could.

– MEDIA MARKERS ===

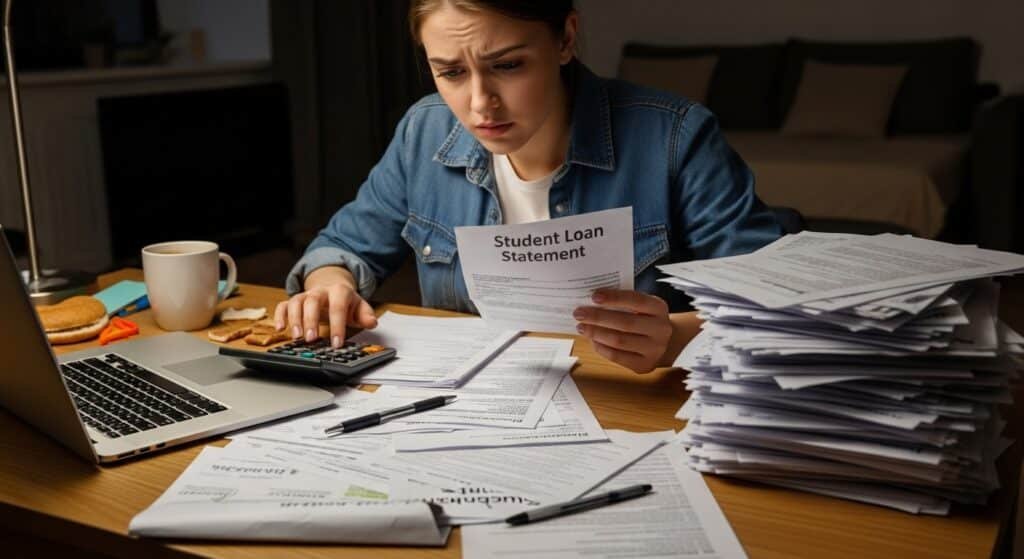

One of the biggest factors in why millennials can’t buy homes is student loan debt that simply didn’t exist for most boomers. The average millennial graduates with $30,000-$50,000 in student loans, creating monthly payments of $300-$1,000 that directly compete with down payment savings.

Federal Reserve research found that every $1,000 increase in student loan debt lowers homeownership rates by about 1.8 percentage points. This isn’t a small effect—it’s a massive systematic barrier. When 60% of millennials cite student loans as the primary reason they can’t buy homes, that represents millions of people locked out of homeownership by educational debt.

How student loans block homeownership:

Boomers attended state colleges that cost a few hundred dollars per semester. Many paid tuition with part-time jobs and graduated debt-free. Millennials face tuition costs that have increased 1,200% since 1980, far outpacing inflation. This fundamental difference in educational costs is a major reason why millennials can’t buy homes while their parents could. Understanding how these systematic changes happened reveals the policy shifts that created this crisis.

Real wages have barely budged in 40 years while housing costs have skyrocketed. This wage stagnation is central to why millennials can’t buy homes even with jobs that sound well-paid on paper. A salary of $60,000 sounds comfortable, but it doesn’t stretch nearly as far as equivalent earnings did in the 1970s.

| Era | Median Home Price | Median Income | Price-to-Income Ratio |

|---|---|---|---|

| 1970s | $26,650 | $7,133 | 3.7x |

| 1980s | $50,000 | $17,710 | 2.8x |

| 1990s | $119,600 | $30,056 | 4.0x |

| 2000s | $174,000 | $41,990 | 4.1x |

| 2020s | $350,000+ | $54,132 | 6.5x |

The table shows exactly why millennials can’t buy homes—the price-to-income ratio has nearly doubled since the 1970s. Housing costs have completely disconnected from wage growth, making homeownership mathematically impossible for most young workers.

Key wage and cost factors:

Someone earning the median income today would need to save for 15-20 years to afford a 20% down payment on a median-priced home, assuming zero lifestyle costs and perfect savings discipline. That’s not realistic. In the 1970s, the same calculation took 5-7 years. The math explaining why millennials can’t buy homes is simple: wages stayed flat while housing costs exploded.

Understanding why millennials can’t buy homes requires looking at what boomers had that no longer exists. It wasn’t about working harder or being smarter with money—it was about economic conditions that made homeownership accessible.

What enabled boomer homeownership:

The minimum wage in 1970 could actually support saving for a home. Today’s minimum wage can’t even cover rent in most cities. Boomers could work a factory job, join a union, earn a living wage, and buy a house within a few years. Those factory jobs are gone. The unions are largely gone. And the wages that remain haven’t kept pace with housing costs.

College tuition at public universities cost a few hundred dollars per semester in the 1960s and 70s. Many students paid tuition with part-time summer jobs. Today, the average cost of public university tuition is $10,000-$25,000 per year, creating debt burdens that didn’t exist for previous generations. This single change explains much of why millennials can’t buy homes compared to boomers.

If the question of why millennials can’t buy homes seems bad, Gen Z faces an even bleaker reality. They’re entering the workforce during and after a pandemic that disrupted traditional career paths, facing the highest housing costs in history relative to income.

Gen Z’s additional challenges:

A staggering 84% of Gen Z report delaying major life milestones—marriage, children, career changes—specifically to save for homes they may never afford. That’s not a generation being cautious; that’s a generation recognizing the math doesn’t work. The homeownership rate for Gen Z currently tracks even lower than millennials at the same age, suggesting conditions are worsening rather than improving.

Why millennials can’t buy homes isn’t just about real estate—it’s reshaping American society. Homeownership has historically been the primary wealth-building tool for middle-class families. When entire generations can’t access it, the consequences spread across every aspect of life.

How the housing crisis affects everything:

Research shows that half of all U.S. renters are cost-burdened, spending over 30% of income on housing. Many millennials spend 40%, 50%, or even 60% of income on rent alone. When housing consumes that much income, saving for a down payment becomes mathematically impossible. The millennial homeownership rate sits at just 47% compared to over 61% for boomers at the same age—a 14-percentage-point gap representing millions of people locked out of wealth-building.

Individual solutions can’t fix systematic problems, but some millennials have found ways to achieve homeownership despite the barriers explaining why millennials can’t buy homes.

Strategies that have worked for some buyers:

The data on family assistance is particularly telling about why millennials can’t buy homes without help. Three-quarters of Gen Z homeowners needed financial assistance from family for down payments. That’s not normal. Boomers didn’t need their parents’ help at those rates because the economic conditions allowed independent homeownership.

The conversation about why millennials can’t buy homes while boomers could on minimum wage isn’t about blaming individuals. It’s about recognizing fundamental economic shifts that locked out younger generations from opportunities their parents enjoyed.

Solving why millennials can’t buy homes requires systematic changes:

Until these systematic issues get addressed, homeownership rates will continue declining and wealth inequality will keep growing. The millennial homeownership rate of 47% versus boomers’ 61% represents millions locked out of the primary middle-class wealth-building tool. Meanwhile, nearly two-thirds of boomer homeowners have no plans to sell, further restricting supply and making it even harder for younger generations to enter the market.

The answer to why millennials can’t buy homes comes down to math that simply doesn’t work anymore. Wages stagnated while housing costs exploded, student debt created a new financial barrier that didn’t exist for boomers, and the economic structures that once made homeownership accessible have been systematically dismantled. Millennials and Gen Z deserve the same opportunities boomers had, but right now, the economic reality makes that impossible for most.

– COUNTER‑ARGUMENT === ## The “Boomer Work Ethic” Objection Some pundits claim boomers simply *worked harder* and were *more frugal*, so they could afford a home on a minimum‑wage job. **Debunked:** That narrative ignores the structural advantages boomers enjoyed: stable manufacturing jobs, affordable suburban land, and a social safety net that kept housing costs low. Today’s workers face **wage stagnation**, **housing prices that have outpaced inflation by 460 %**, and **student‑loan debt** that didn’t exist for their parents. The “hard‑work” excuse is a convenient myth that masks policy‑driven inequality.